Even as economies are battered by COVID-19, digital infrastructures are booming, offering a critical lifeline for an anxious world on lockdown. The telco investment landscape is thriving – yet it has not yet reached its full potential. What will it take for telco investment to match the industry’s prospects?

Part of the challenge is that there is a talent gap to be bridged. Businesses in the sector need to recruit a new class of executive, with a skillset encompassing tech know-how, entrepreneurial verve, training in dealing with public bodies, and the capacity to navigate a complex regulatory environment. Such individuals are rare, and the field competitive. Indeed, industry goals may be best achieved by putting together crack teams of managers that encompass the complementary talents and levels of experience needed to tackle new realities. With challenges come opportunities, and the rewards of finding the right mix of leaders promise to be immense.

To shed more light on this dynamic moment, Boston Consulting Group and Egon Zehnder have interviewed top managers, infrastructure investors, telco incumbents, and players in the emergent asset class of pure digital-infrastructure companies.

With work from home, online education, and streamed entertainment, the world is relying ever more on digital communication, including a substantial increase in the use of mobile technology. All of this puts great pressure on the industry to keep up with demand, especially in regions that still need to develop their digital and communications infrastructure. A highly competitive and increasingly global industry is emerging from the fragmentation of once vertically integrated telco operators.

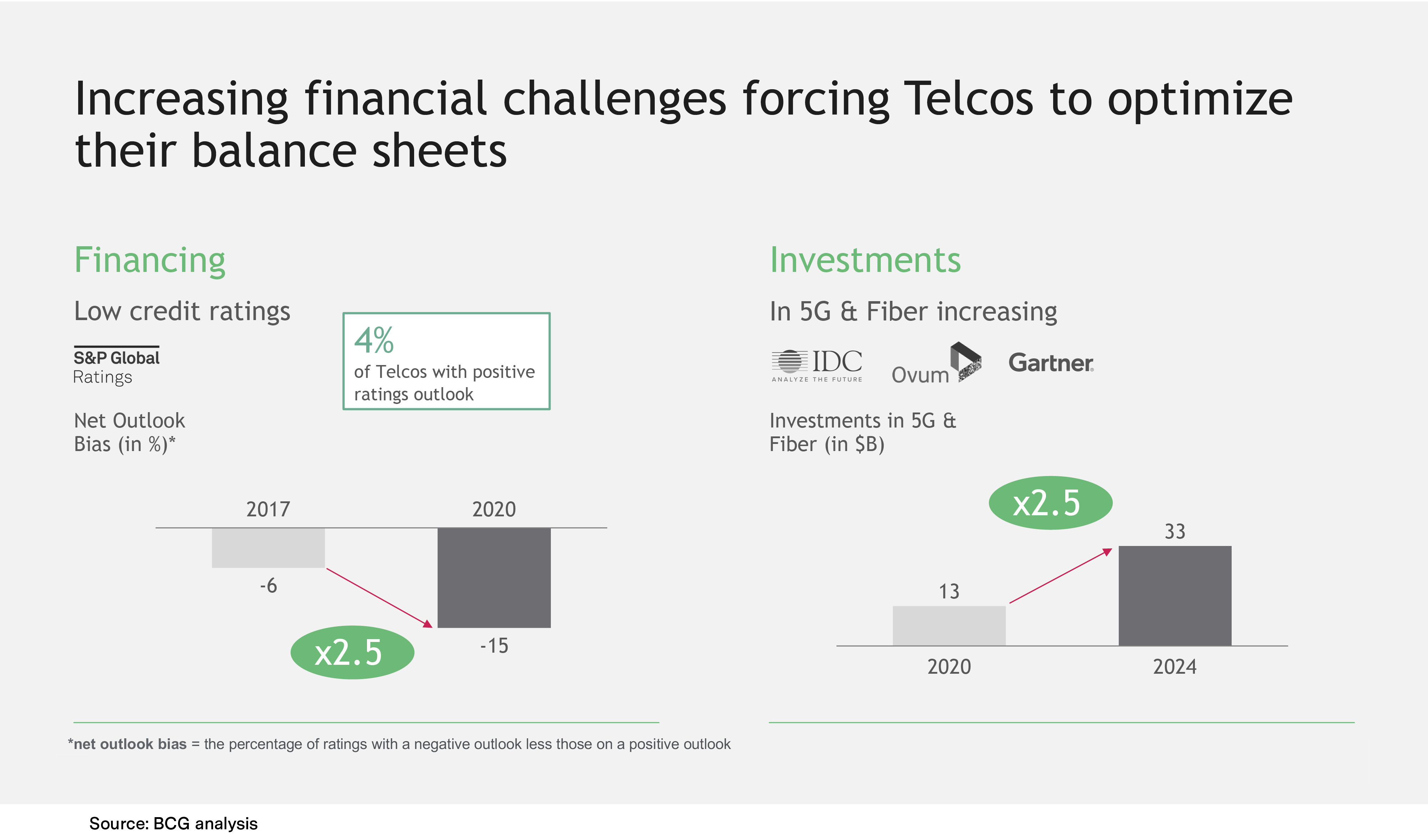

Despite this vibrant environment, recent investment in the industry is surprisingly sluggish. Poor valuation and low returns are proving challenging for industry players – particularly those in integrated telecoms. With a median Total Shareholder Return (TSR) of just 5% (across a 3-year annual average), telco ranks low in terms of shareholder value creation; the stellar performance of other industries, such as medical technology (19% TSR), remains tantalizingly out of reach.

Why the slowdown? Integrated telcos face numerous challenges, such as low scalability due to a local footprint, new competitors entering the market, high regulatory burdens, and hesitation to digitize. Pure infrastructure players, meanwhile, are faring significantly better, according to recent BCG analysis. With the advent of 5G and the substantial surge in demand for data-center capabilities, towers, and fiber-optic cables, a massive new asset class is emerging – one that promises very attractive yields and long-term, predictable cash flows.

It’s no surprise, then, that new business models are gaining traction fast, particularly those carving out infrastructure development from Service Companies (ServCos). The pure Network Companies (NetCos) thus created are turning towards new ownership models, increasingly fostering cooperation and co-investment. According to conservative estimates from Mergermarket, more than 50 deals involving fiber, towers, and data-center companies have been made in the past years in the DACH region alone.

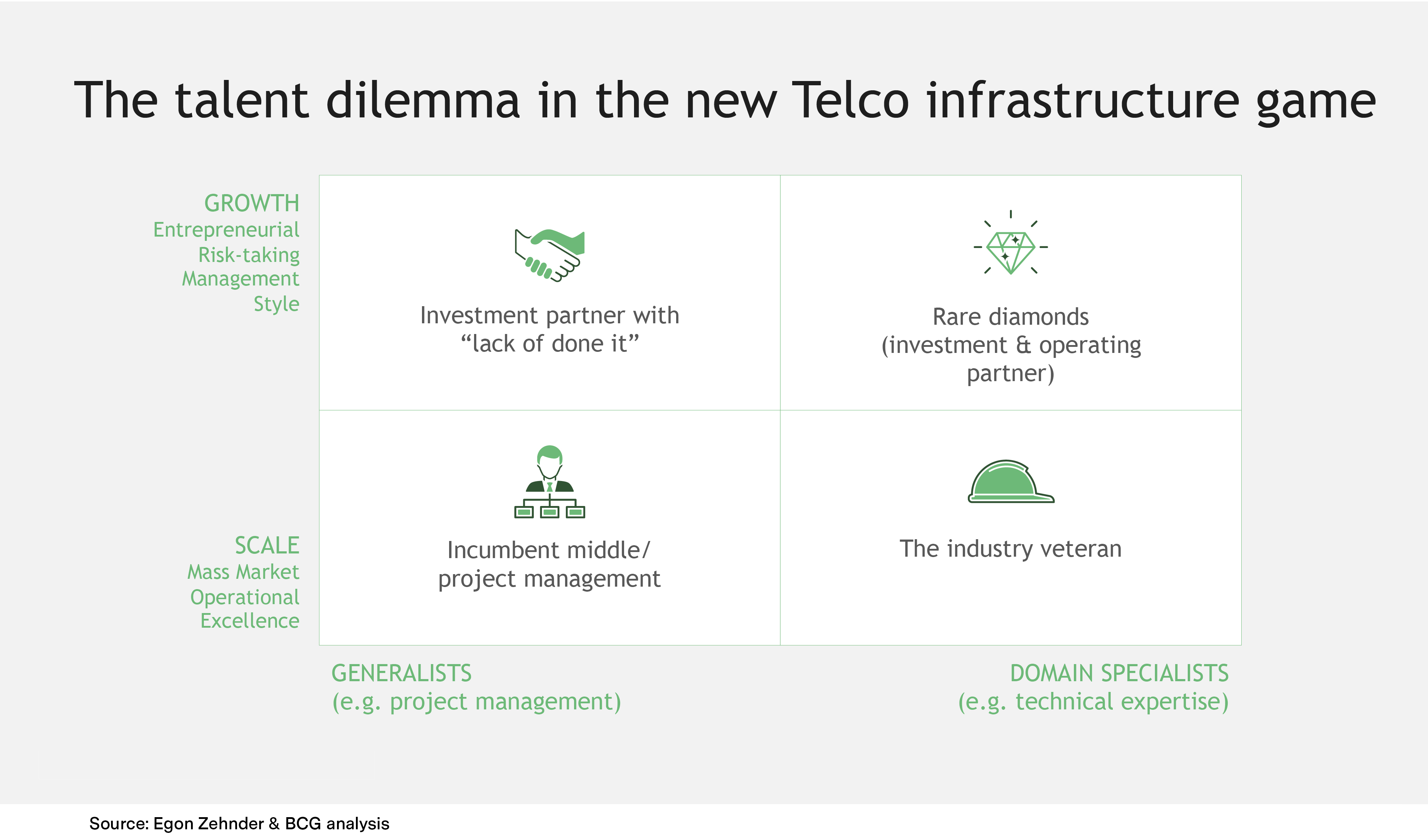

Though investors have been shunning investments in integrated telcos, they are favoring investments in digital infrastructure. This year could see capital flow in infra funds on a record level, and we regularly hear of capital raising in billions for new funds. Here too, talent is crucial: The limiting factor is the supply of top personnel. Operating and investment partners with a digital infra background are very much in demand.

Greenfield rollout of fiber broadband presents major investment opportunities – and this is an area with a significant talent gap. Given that major European countries like Germany mark the lower end of fiber coverage in the OECD (11% compared to France targeting 80% fiber coverage), investors’ appetite to invest long-term in low-risk returns is very high and warmly welcomed by politicians and broadband users in need. As a consequence we are seeing more and more established city and regional carriers rolling out fiber in their footprint. Additionally, a growing number of heavily funded new ventures are setting up operations with industry veterans and PE-experienced company-builders to announce multi-billion roll-out plans. On top, investment funds are aggressively hunting for existing fiber infrastructure targets in Europe, with new alliances forming between incumbents, and we are seeing new ventures, construction companies, and funds heat up the race for fiber – and the rare talent to execute the ambitious business plans.

Currently, the tower markets in the US and Europe are roughly similar in size, with 170,000 sites in the US and 220,000 in Europe. However, while the market is already relatively consolidated in the US (where 90% of towers are privately owned), Europe (50% private ownership) offers immense opportunity for private investment.

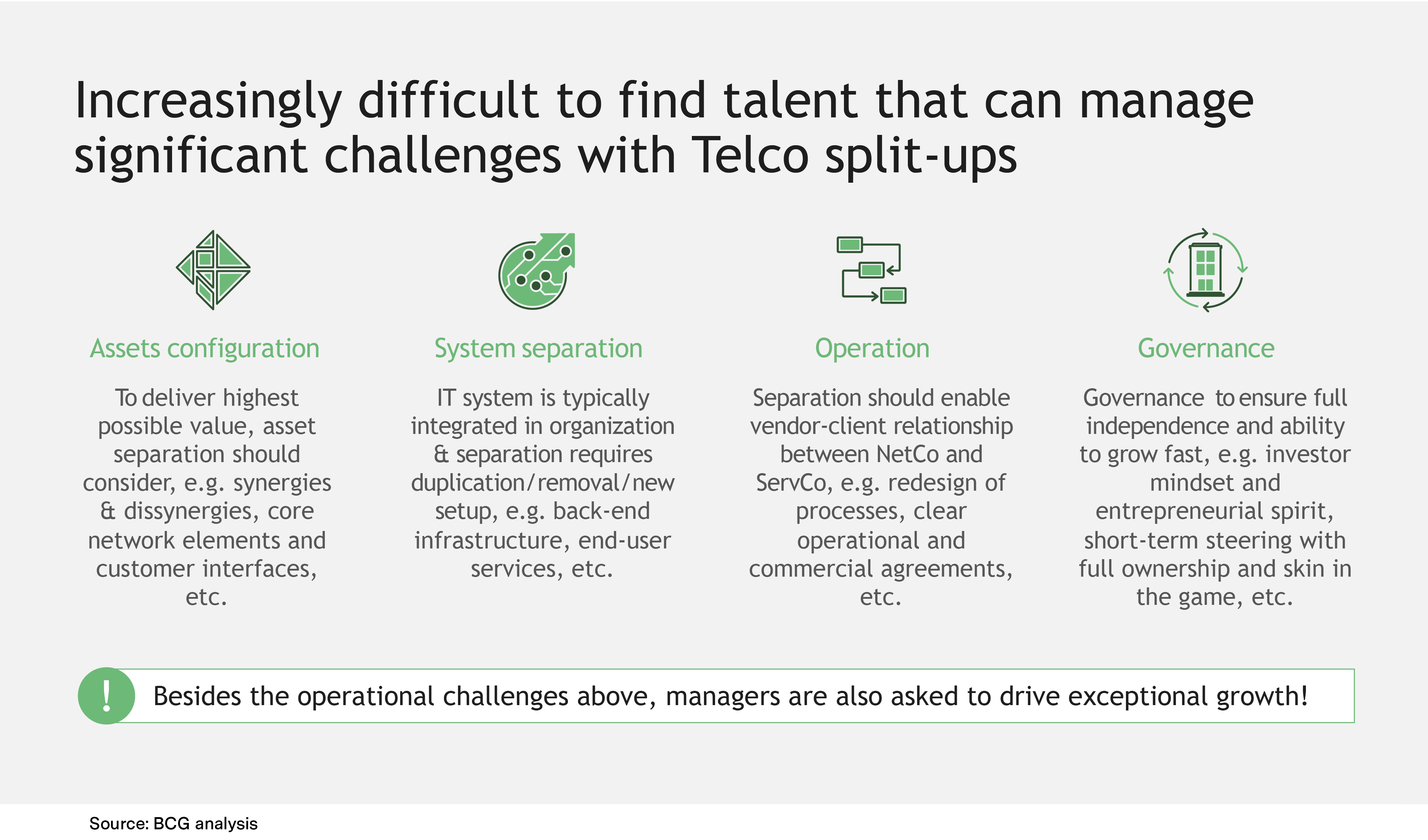

Managing these new alliances, and the separation of businesses in a highly dynamic market, are challenging and complex tasks. They involve configuring assets the right way, setting up independent governance structures, defining the vendor-client relationship between NetCos and ServCos, and separating former jointly used IT systems.

Such a role calls for leaders who combine technical expertise with a sharp investor mindset. Deep and broad tech and operational expertise is called for to manage asset configuration, deliver expected infrastructure synergies, and establish the right IT systems and processes. The pool of talent meeting the above requirements seems highly limited, and talent scarcity is further exacerbated by US players hunting for talent in Europe. Tech veterans with a broad skillset are in huge demand, and finding them grants a distinct competitive advantage. Take network rollout: Operational excellence and execution are key to the successful fulfillment of ambitious plans.

Cultural fit plays an equally important role: A truly entrepreneurial mindset, a strong focus on innovation, excellent negotiation skills, the ability to perform in a high-pressure environment, and agile ways of working are essential to success in a fast-moving, competitive infrastructure space.

Current senior telco leaders may seem to have suitable technical and operational expertise to drive the newly created infrastructure players; but in many cases, the effort required to shift their leadership profile to drive innovation while dealing with investors and with regulatory and institutional stakeholders may be an unbearable stretch.

In our work, we have learned that the answer will increasingly lie in greater collaboration and teamwork: The search focus must shift from individuals to outstanding teams, composed of exceptional managers with complementary talents. In addition, getting access to roll-out targets and deal flow, as well as navigating the political and regulatory environment, calls for adding senior advisors – a role that has recently been on the rise in the infrastructure space.

As with so many leadership dilemmas, tackling this moment in telco development will require introspection and self-awareness from senior players. Such reflection can allow executives to perceive the limitations of old styles and narrow categories of leadership, and to grasp the power of building teams with complementary experience and expertise.