The role of the CFO has transformed dramatically in recent years.

What was once primarily about managing finances has evolved into a position of critical strategic leadership.

Today’s CFOs are expected to guide their organizations through complex global markets, lead mergers and acquisitions, drive sustainability initiatives, and shape long-term corporate strategy—all while keeping a firm grip on financial performance.

This heightened demand for strategic financial leadership has made the competition for top CFO talent fiercer than ever. Companies are starting to offer more than just attractive compensation packages—they’re creating pathways for career advancement and deep involvement in the overall business strategy to entice the best candidates.

With so much riding on the right hire, finding a CFO isn’t just about filling an empty seat.

It’s about securing the financial leader who will shape your company’s future.

In this guide, we’ll share key insights, timelines, and best practices drawn from Egon Zehnder’s decades of experience in CFO succession and executive search.

First, let’s cover some basics:

What is CFO Executive Search?

CFO executive search is a specialized recruitment process designed to identify and secure top financial leadership talent for organizations. Unlike traditional hiring, this process emphasizes finding candidates who possess strong financial acumen and demonstrate strategic leadership, cultural fit, and the ability to navigate complex, global markets.

Who Owns CFO Executive Search?

Finding the right CFO is one of the most critical decisions a company can make, and many organizations turn to proven executive search firms to lead the process.

These firms bring deep expertise, industry connections, and a global reach to identify and vet the best candidates.

Why is CFO Executive Search So Important?

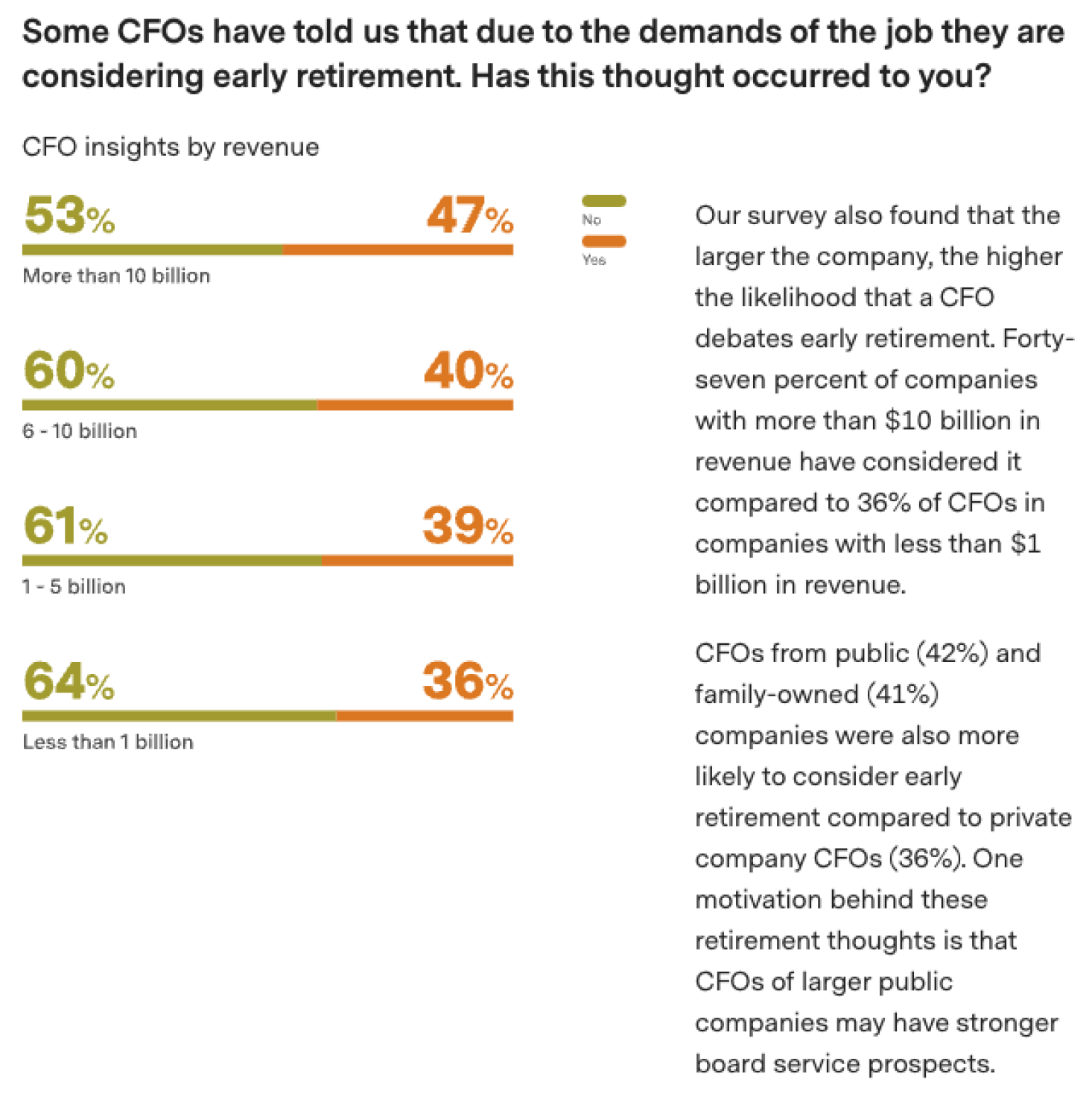

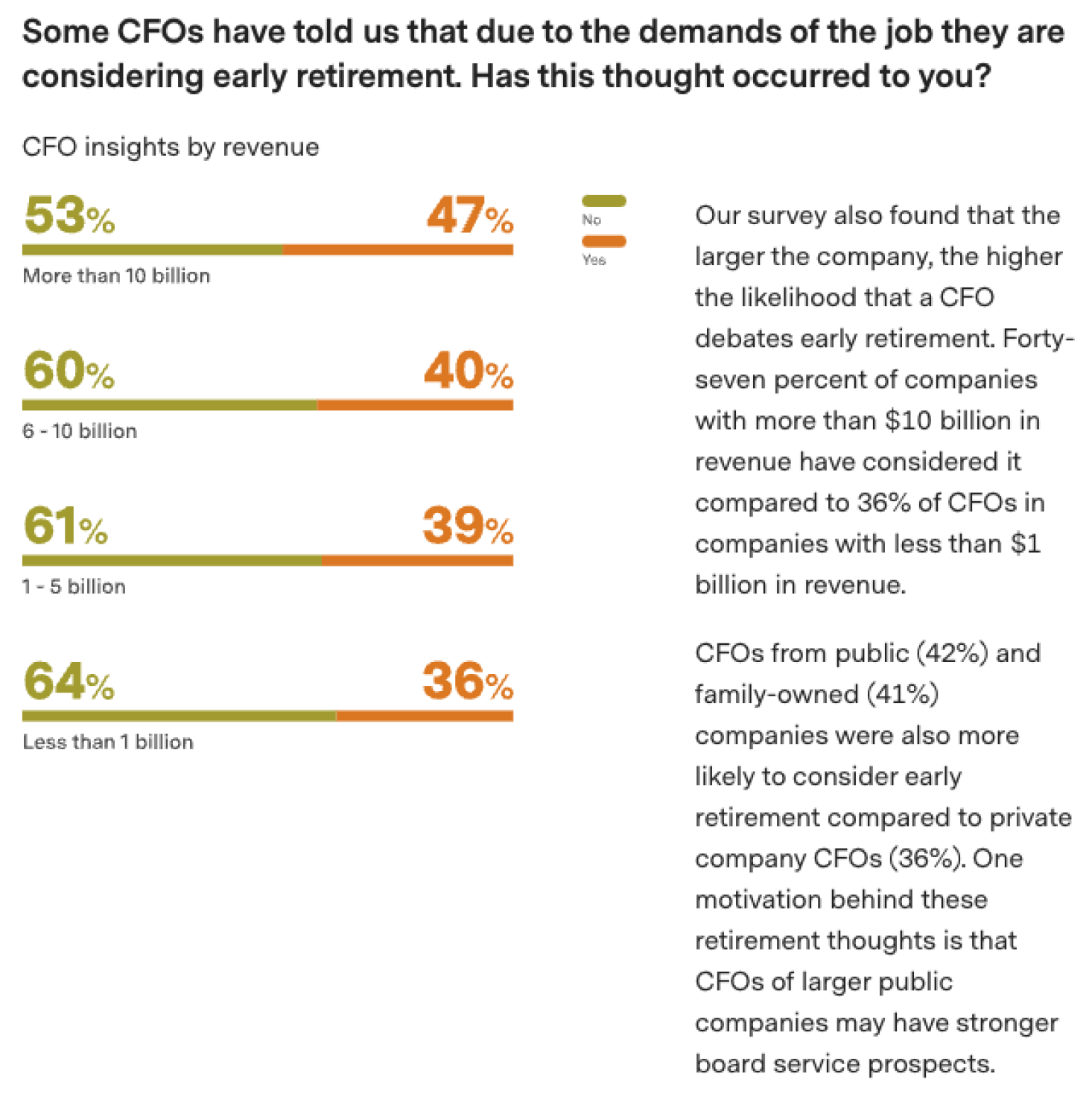

Executive search is critical for organizations seeking top financial leadership due to the increasing complexity and demands of roles like CFO. According to research from our Super CFO Report, 47% of CFOs from companies with more than $10 billion in revenue have considered early retirement, driven by the growing responsibilities of the position.

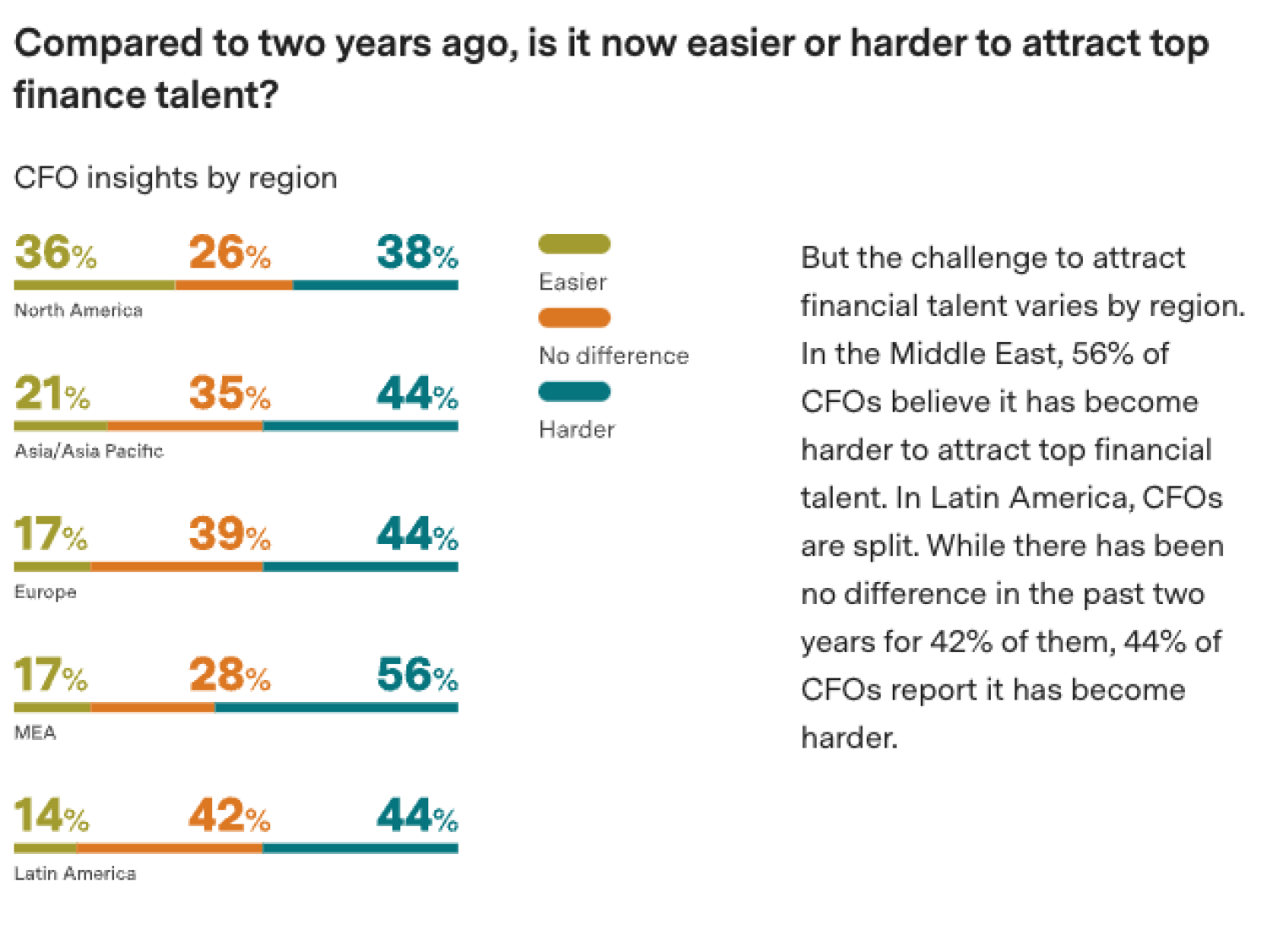

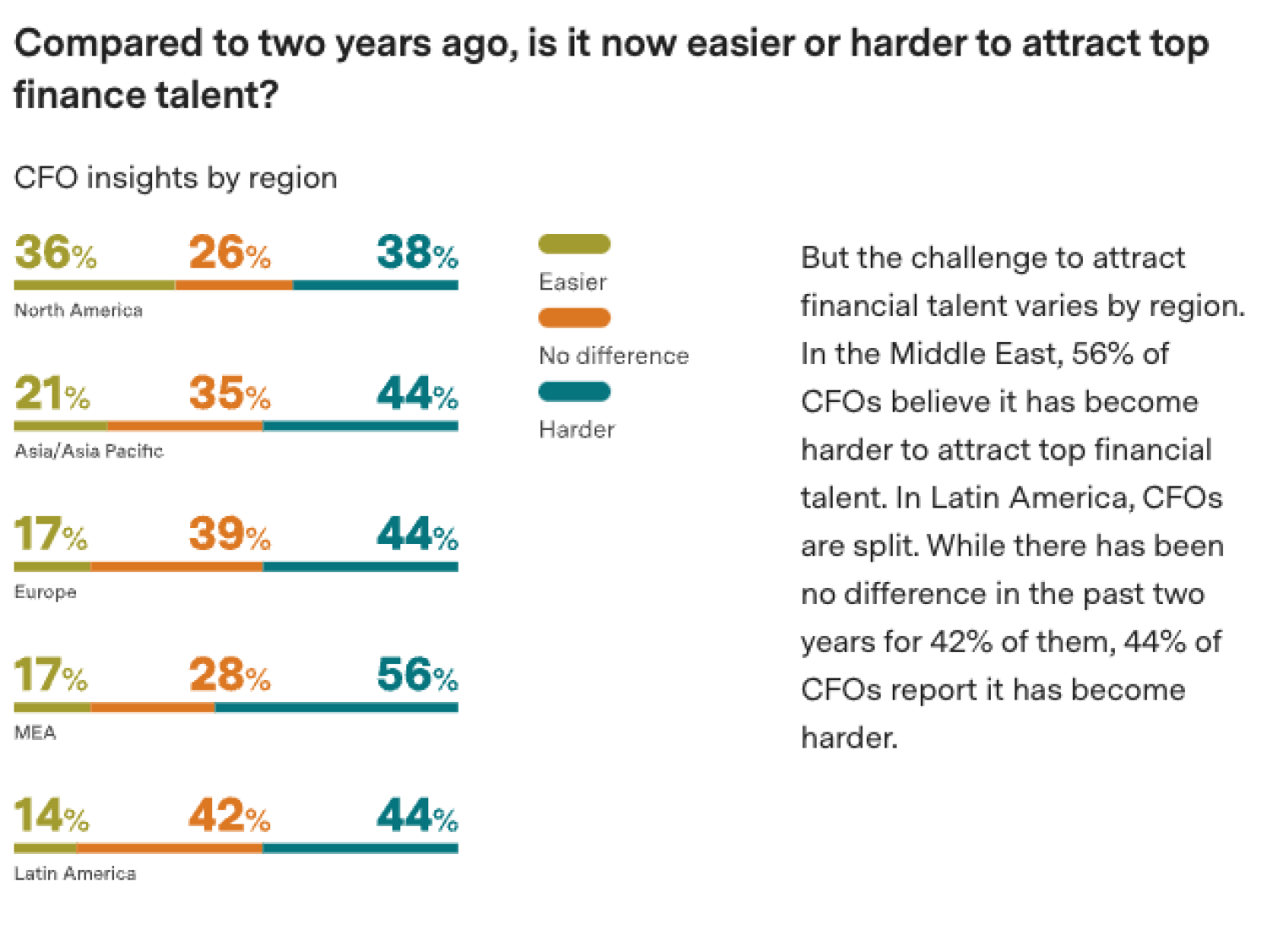

Additionally, 56% of CFOs in the Middle East and 44% in Latin America report it has become harder to attract top financial talent in recent years.

And that’s not all.

Did you know that companies that focus on building strong executive teams, as noted by 60% of CFOs, are more likely to attract high-quality candidates?

With the competition for experienced financial leaders intensifying, the right executive search firm can provide a structured, proven approach to identifying candidates who meet technical and operational requirements and align with a company’s culture and long-term goals.

Keep Reading: Addressing the High Rate of CFO Turnover

How the CFO Role Has Changed Over the Past Decade

According to our recent survey, 82% of CFOs have taken on expanded responsibilities beyond their original scope, reflecting the increasing complexity of their role. Gone are the days when a CFO was expected to simply manage a company’s finances.

Key responsibilities now include leading financial risk management, ensuring regulatory compliance, leveraging advanced technologies like artificial intelligence, and guiding cross-functional teams.

CFOs are also expected to collaborate closely with CEOs, providing strategic foresight and co-leadership.

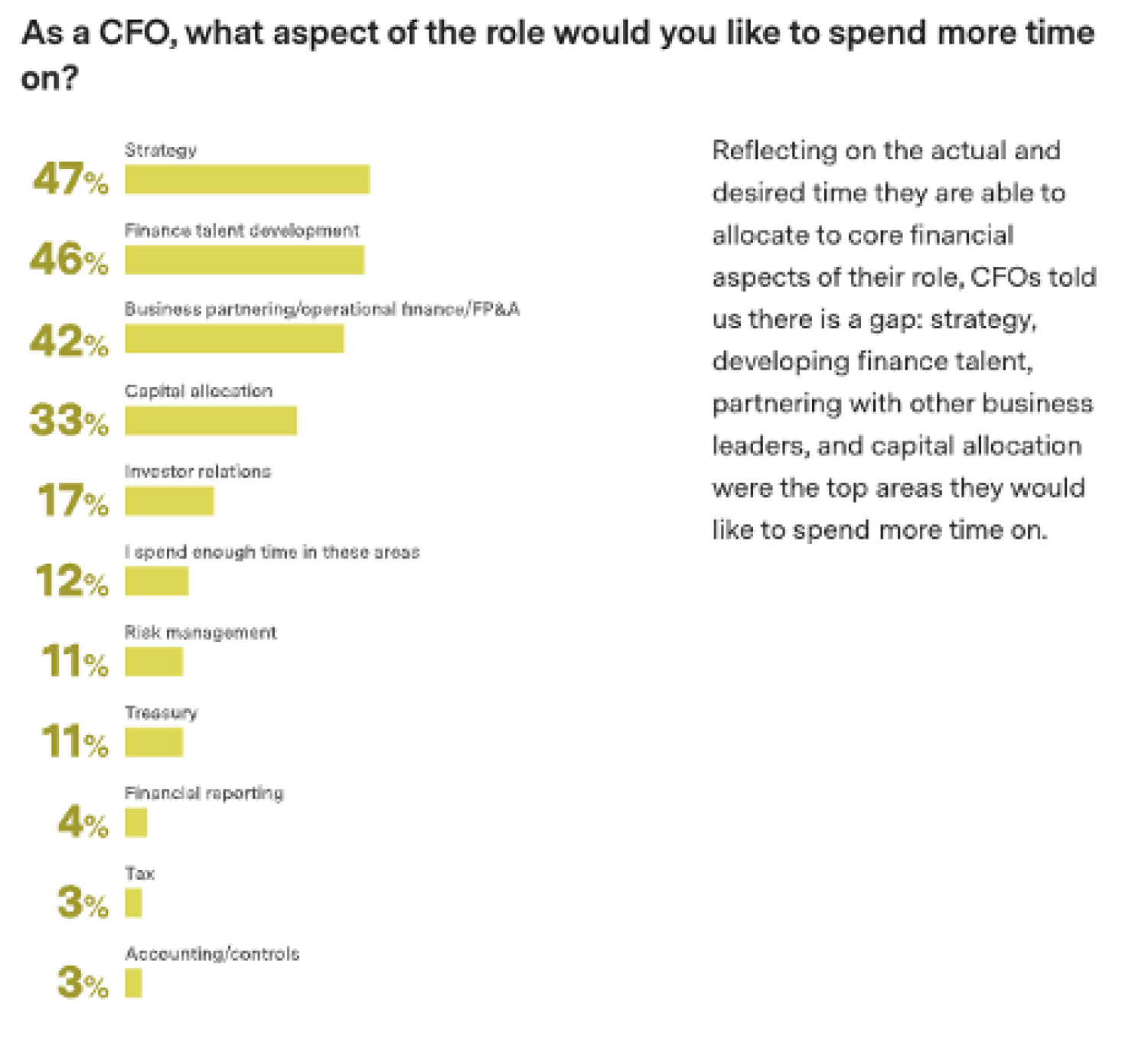

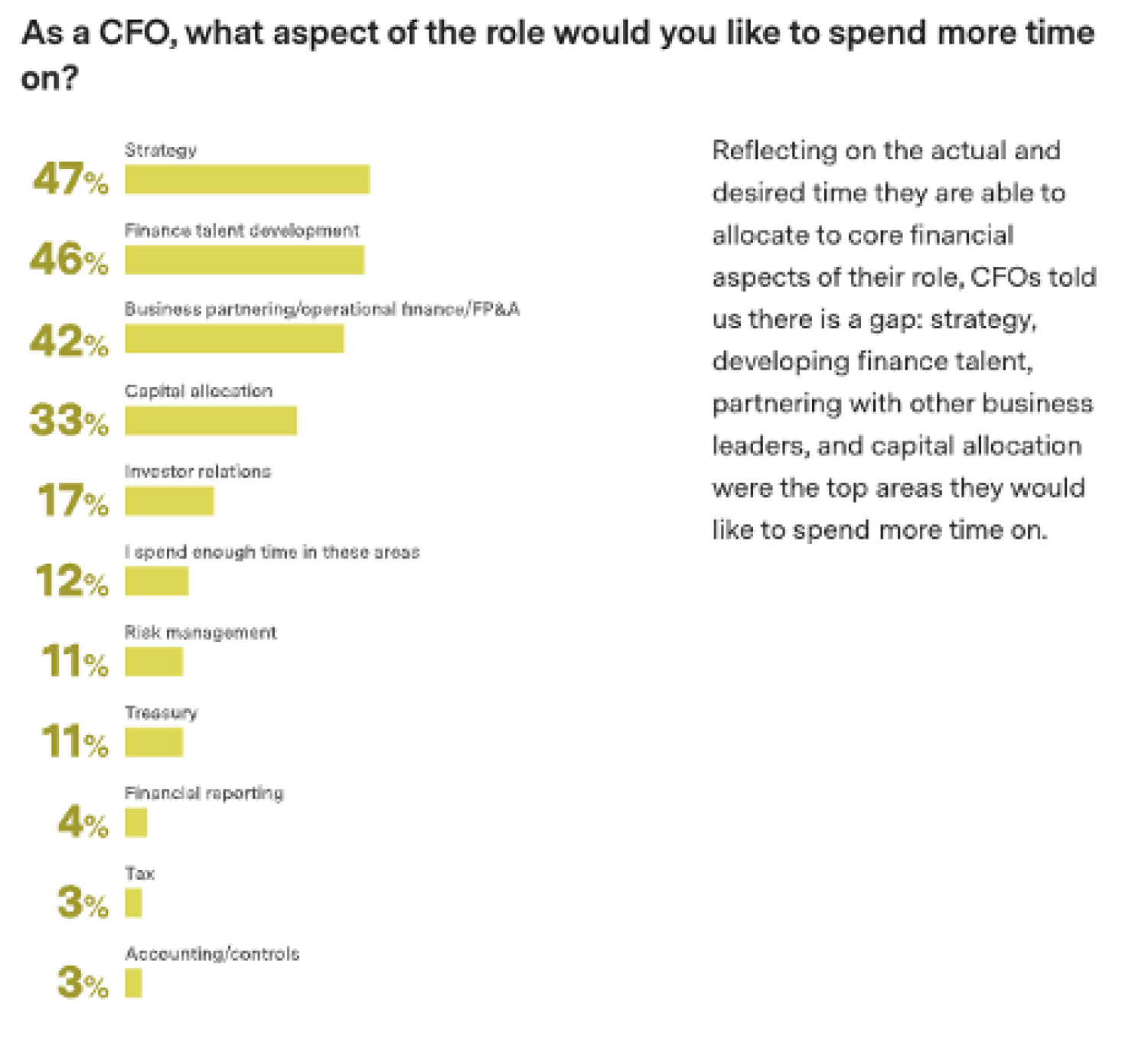

While 47% of CFOs would like to spend more time on strategy, their time is frequently spent on other business tasks.

With this expanded set of responsibilities and expectations, it's incredibly important to weigh and measure the strengths and weaknesses of your current or incoming CFO – this will enable you to support them as their role continues to adapt and change in the years to come.

Keep Reading: Measuring CFO Strengths and Weaknesses

So, what makes a great CFO in today’s business environment?

Let’s dive in.

CFO Roles & Responsibilities

When it comes to CFO executive search, certain skills and competencies should be at the top of your search list.

Here are just a few of the most important:

1. Strategic Integration

CFOs today are often seen as co-pilots to CEOs, involved in shaping company strategy alongside core financial responsibilities. And that’s not surprising.

According to our research, 60% of CFOs want to be chief executives, and 7 in 10 say they are ready to become CEO now.

The CFO you hire must possess analytical prowess and strategic foresight, enabling them to forecast future financial landscapes and guide significant business decisions.

2. Leadership and Collaboration

Today, CFOs are expected to be influential leaders within the finance team and the entire organization. The right candidate should demonstrate a proven ability to lead cross-functional teams and foster collaboration across departments, ensuring the company’s financial strategy is embedded throughout the business.

Not to mention, their leadership style should drive innovation and inspire alignment with overall corporate goals.

3. Technological Adaptation

In the era of digital transformation, your CFO must have a strong grasp of emerging technologies that can enhance financial processes and reporting. It’s not enough to understand finance—they must also be able to implement advanced systems, including AI and machine learning, to drive efficiency and deliver critical data analytics. Look for a candidate who embraces technology and understands how it can shape the future of both the finance function and the business as a whole.

4. Risk Management and Compliance

Given today’s volatile markets, the CFO must be adept at identifying and managing financial risks. They should demonstrate a proactive approach to risk management—someone who is always two steps ahead in terms of mitigating disruptions and ensuring compliance with complex local and global regulations.

Strong candidates will be those who can keep the business resilient while navigating economic uncertainty.

5. Environmental, Social, and Governance (ESG) Responsibilities

Increasingly, CFOs are being tasked with leading Environmental, Social, and Governance (ESG) initiatives, ensuring that financial performance is balanced with sustainable and ethical practices. A successful CFO candidate will understand the importance of integrating ESG metrics into financial planning and reporting, positioning the company as both profitable and responsible. Look for someone who prioritizes sustainability and can meet the growing expectations of stakeholders, investors, and regulators.

Keep Reading: CFO Competencies, Skills, and Potential: The New Playbook

The modern CFO role has expanded far beyond traditional financial management, encompassing a wide range of new responsibilities.

In our Super CFO Survey, we asked CFOs which, if any, new responsibilities they had taken on in the last two years.

CFOs are deeply involved in areas like Environmental, Social, and Governance (ESG) initiatives (55%), mergers and acquisitions (44%), and corporate strategy (38%). They also take on co-leadership roles alongside CEOs (35%) and manage cybersecurity (27%), IT (24%), and digital transformation (23%).

This shift reflects the increasing complexity of the CFO position, where financial leaders are expected to guide not only financial but also strategic and operational areas of the business.

Only 7% of CFOs report no new responsibilities, highlighting the evolving and expanding nature of the role.

Keep Reading: Chief Financial Officer Roles and Responsibilities: Navigating the Shift

The 10 Biggest Challenges for CFOs Today

As is clear by now, the CFO role has never been more demanding or multifaceted. As organizations evolve and the economic landscape shifts, CFOs face a unique set of challenges that test their capabilities and resilience.

Here are some of the most significant hurdles we’re seeing CFOs encounter:

1. Expanded Responsibilities

With ESG initiatives, M&A, and strategic corporate planning in the mix, balancing these diverse responsibilities without losing focus on the core financial functions is a major challenge.

2. Technological Adaptation

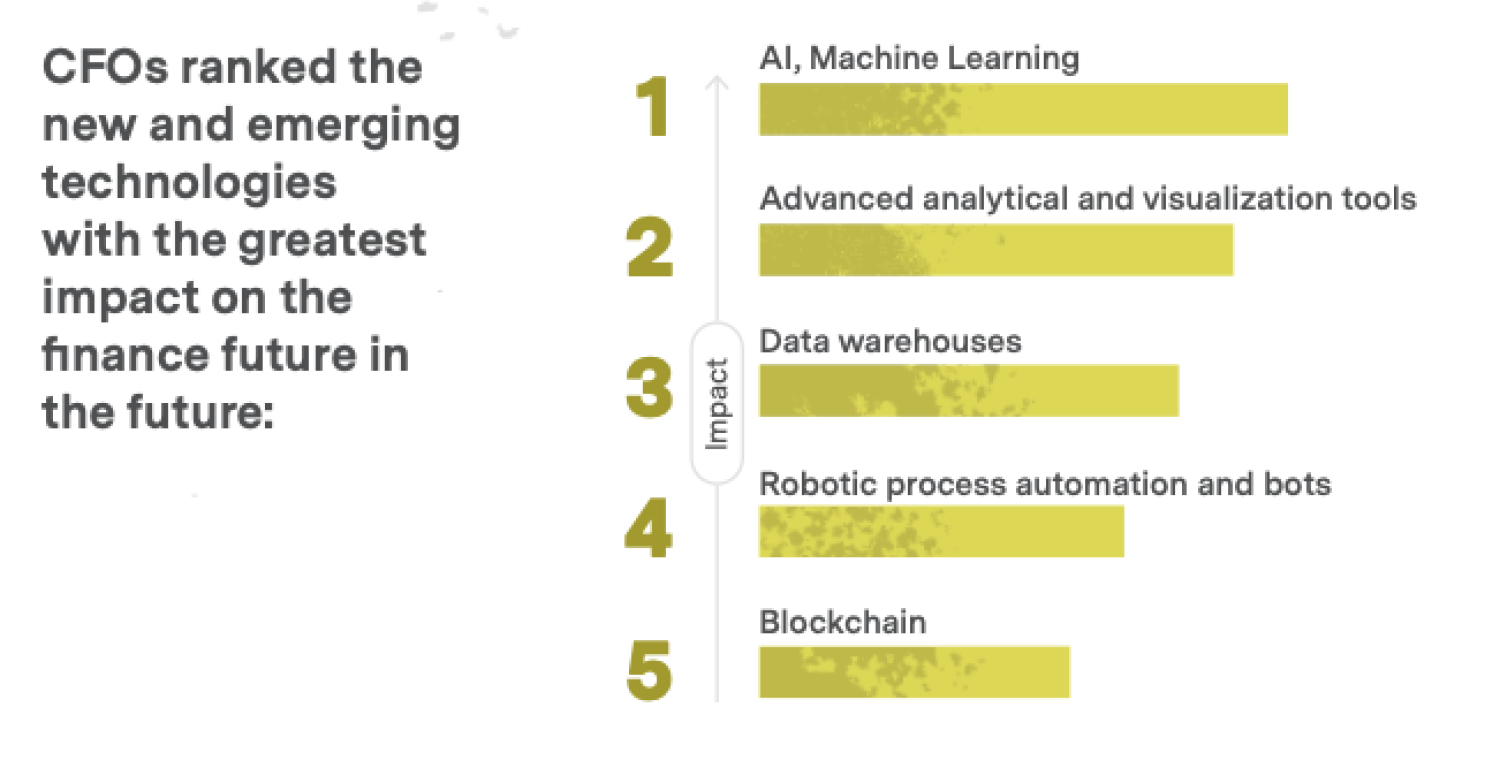

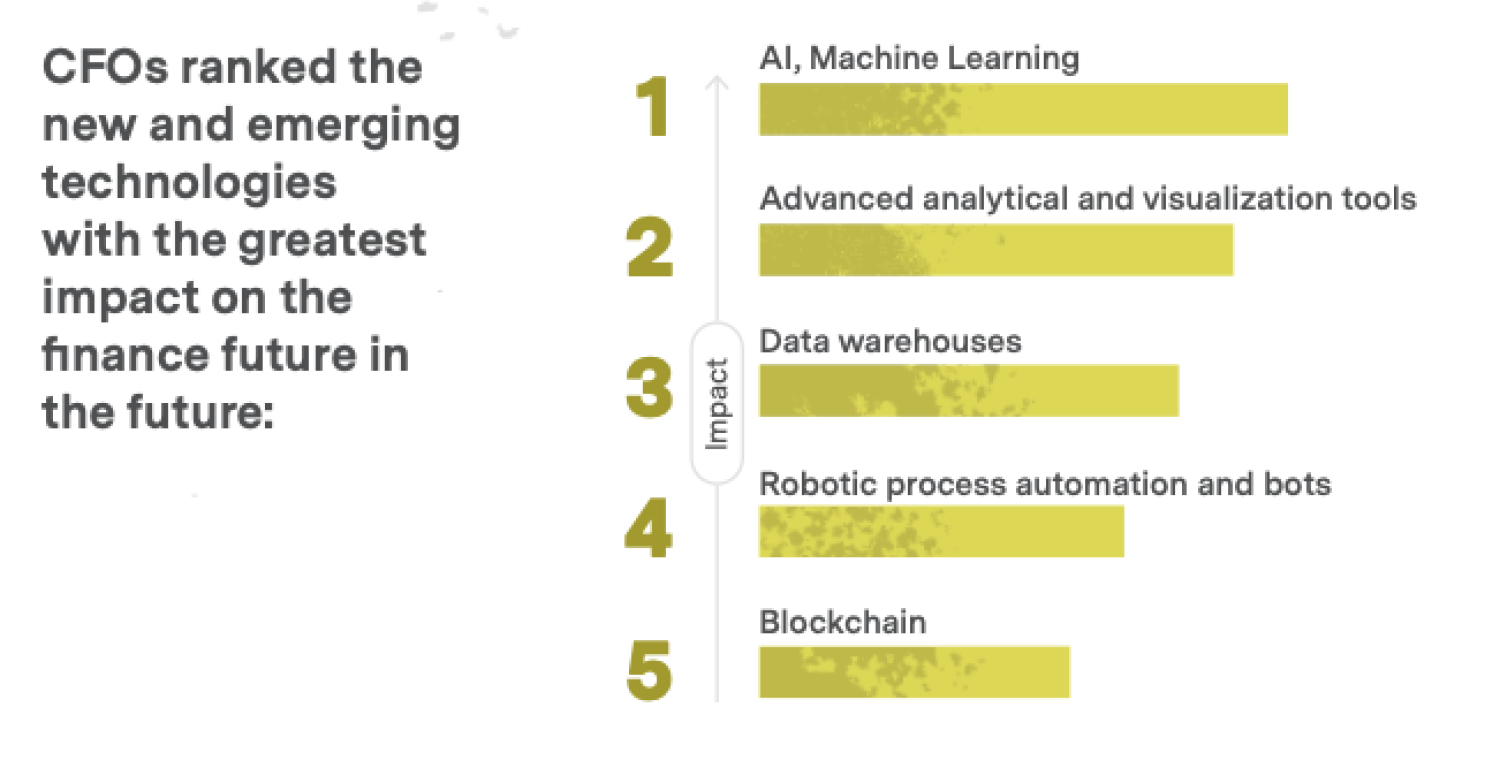

With rapid advancements in technology, CFOs are expected to spearhead digital transformation initiatives within their organizations. Embracing new technologies like AI, machine learning, and advanced analytics is essential for enhancing financial processes and strategic decision-making. However, staying abreast of these changes and implementing them effectively can be daunting.

Check out these statistics from our Super CFO Survey on new and emerging technologies.

3. Regulatory Compliance

Navigating the complex and ever-changing landscape of global regulations is a significant challenge. CFOs must ensure compliance with financial regulations across different regions while also managing potential risks associated with regulatory changes.

4. Talent Management

Attracting and retaining top finance talent is critical to the success of any organization—but it’s also harder than ever to find the right people. In fact, two-fifths of CFOs say it’s harder to attract top financial talent today than it was two years ago. CFOs need to build and maintain high-performing teams capable of meeting the increasing demands of the finance function. This includes not only hiring the right people but also continuously developing their skills and capabilities.

5. Strategic Influence

Today’s CFOs are expected to play a key role in shaping corporate strategy. This requires a shift from being just number crunchers to becoming strategic partners who can provide insights that drive business growth. However, expanding their influence across non-financial areas of the business can be challenging.

6. Risk Management

As the architects of business resilience, CFOs are tasked with foreseeing potential risks and preparing for them. This includes economic uncertainties, market volatility, and financial risks that could impact the organization's performance.

7. Stakeholder Communication

Effective communication with various stakeholders—ranging from board members and investors to employees and external partners—is crucial. CFOs must articulate complex financial data and strategic plans in a way that is accessible and convincing.

8. Career Progression

Many CFOs aspire to become CEOs, but the path to the top is often hindered by limited visibility and networking opportunities. Overcoming these barriers to enhance their executive presence and leadership profile is a key challenge for many finance leaders.

9. Work-Life Balance

Despite their expanded roles, maintaining a good work-life balance remains crucial for CFOs. The good news is that only one-fifth of CFOs say their work-life balance is poor. Ensuring they manage their workload effectively while fulfilling their responsibilities at work and home is a constant juggle.

10. Navigating Strategic Shifts

When companies undergo significant strategic changes, such as mergers or pivots in business models, CFOs play a critical role in ensuring financial stability and alignment with new business objectives. Adapting quickly to these changes and re-aligning financial strategies accordingly is essential but challenging.

Each of these challenges requires a nuanced approach and strategic thinking, qualities that modern CFOs must continually develop to steer their organizations toward sustained success.

Now that we've covered the evolving responsibilities and challenges faced by today’s CFOs, it’s clear just how vital it is to find the right person for this complex role.

So, how do you ensure you find the perfect fit?

Let’s dive into some practical tips for implementing a successful CFO executive search.

Keep Reading: What Makes an Ideal Private Equity CFO?

The CFO Executive Search Process

The search for a new CFO involves a few key steps:

- Defining the role: Clearly articulating the expectations and responsibilities of the CFO position.

- Candidate sourcing: Identifying potential candidates through networking, direct outreach, and executive search firms.

- Assessment: Rigorously evaluating candidates through interviews, assessments, and reference checks.

- Selection and offer: Choosing the right candidate and negotiating terms that align with both parties' expectations.

How to Evaluate Potential CFO Candidates

When it comes to evaluating potential CFO candidates, working with a proven global executive search firm like Egon Zehnder can be a game-changer.

Egon Zehnder’s expertise allows companies to assess candidates holistically, considering not just financial acumen but also the ability to drive strategic initiatives, lead cross-functional teams, and navigate complex market dynamics.

But planning your CFO executive search doesn’t have to wait until there’s a vacancy.

You might also consider hiring a CFO executive search firm to help you build out a comprehensive succession plan.

What Is CFO Succession Planning?

CFO succession planning is a strategic process designed to identify and develop candidates for the CFO role, ensuring a seamless transition when the current CFO leaves or retires. Unlike traditional executive searches, CFO succession planning takes a proactive approach that involves assessing and developing potential internal talent over time, as well as benchmarking both internal and external candidates against market standards to ensure they will meet the evolving needs of the organization.

CFO Executive Search vs. CFO Succession Planning

While many people use these terms interchangeably, they are decidedly different.

A CFO executive search typically focuses on filling a vacancy as quickly and efficiently as possible, whereas CFO succession planning is a more deliberate and forward-looking process.

Succession planning anticipates future leadership requirements and cultivates a pipeline of talent with potential to deliver on the company's long-term goals, meeting current and future challenges.

This approach often leverages internal talent development to provide continuity and preserve organizational knowledge.

Why is this?

Once primarily viewed as gatekeepers of financial integrity and reporting, today's CFOs are emerging as architects of business resilience and growth.

With all of this in mind, let’s take a closer look at succession so we can understand the nuances between the two types of planning in more depth.

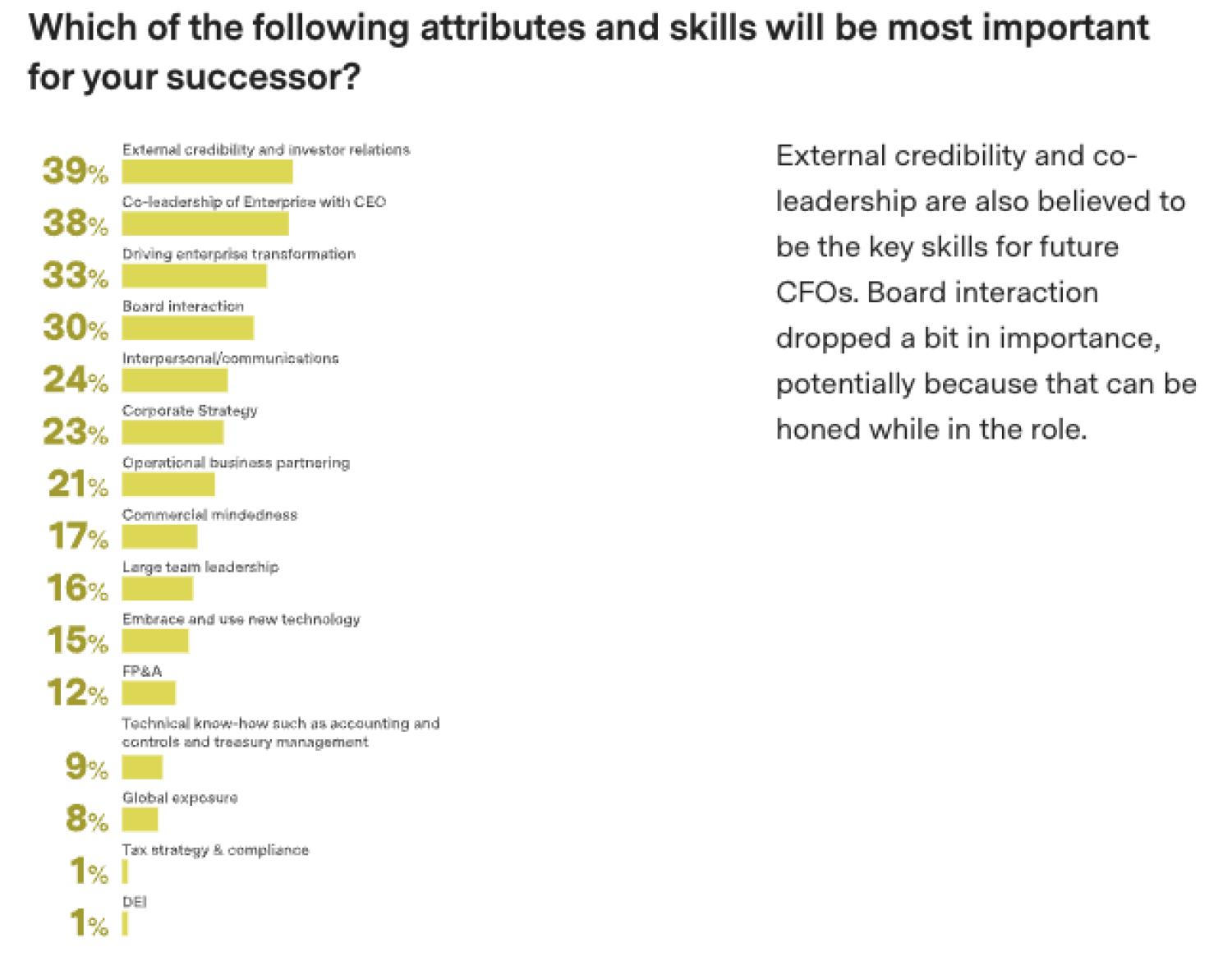

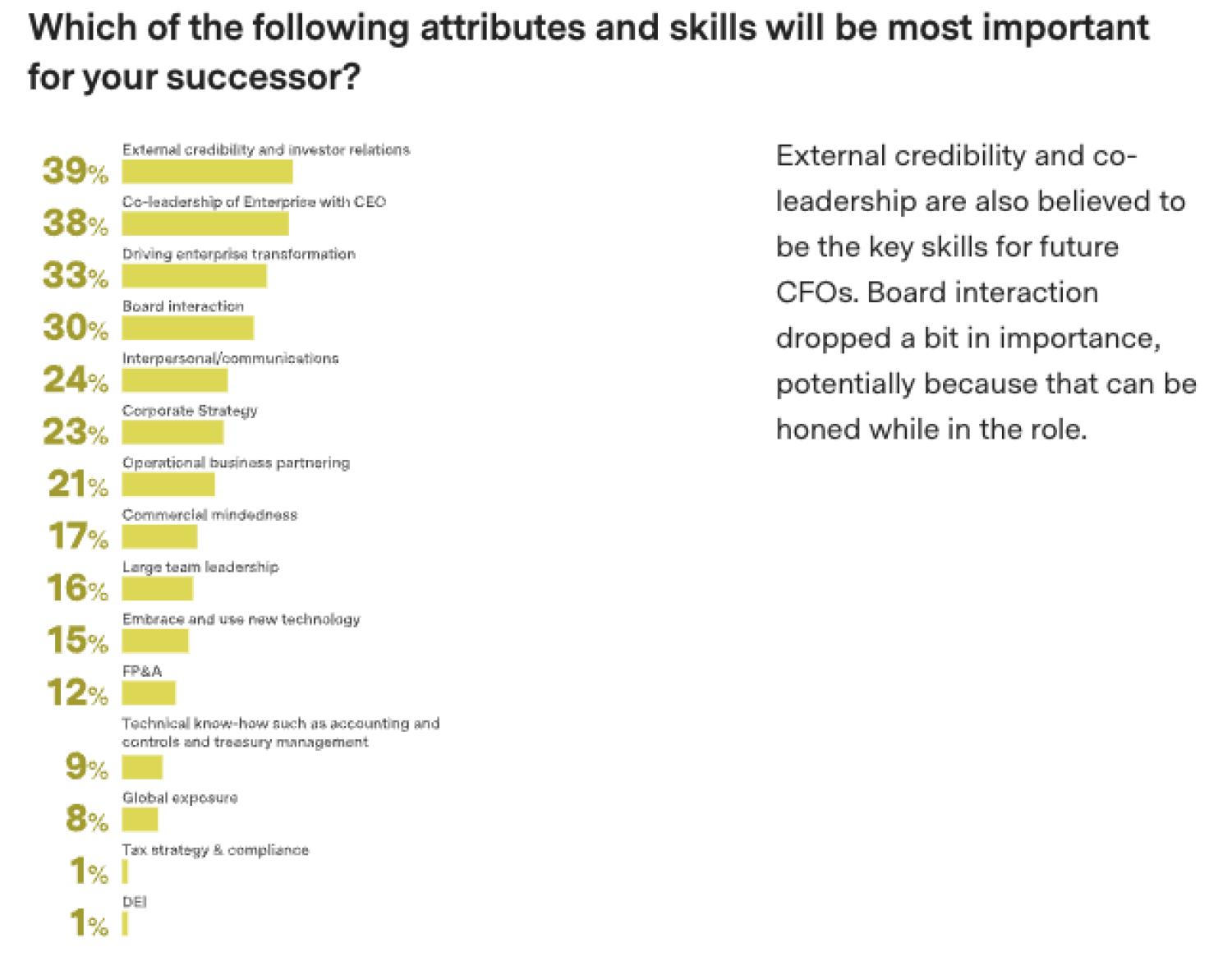

We asked CFOs which attributes and skills would be most important for their successor.

Here’s what they said:

Choosing the Right CFO Executive Search Partner

Selecting the right executive search partner will help your team secure a CFO who can drive your organization's long-term success.

When choosing a search firm, consider:

- Experience and track record: Evaluate their history in successfully placing CFOs within your industry and their understanding of market dynamics.

- Strategic insight: The ability of the firm to provide strategic insights and guidance beyond the search process.

- Global and local market knowledge: Their grasp of both global trends and local market specifics that can influence CFO roles.

Egon Zehnder’s Approach to CFO Executive Search

Egon Zehnder uses a proven approach to CFO executive search, characterized by deep industry insights, a global network, and strategic alignment.

Our team brings extensive, industry-specific knowledge that allows us to deeply understand the unique challenges and opportunities within your sector. If we’re looking outside of your four walls for a candidate, we leverage our wide-reaching global network to source top-tier talent from around the world, ensuring a diverse pool of qualified candidates.

No matter if we’re dealing with an external hire or a succession candidate, we focus on aligning the potential CFO’s capabilities with your organization's long-term strategic goals, ensuring they can contribute effectively to your success.

This tailored approach ensures that the CFOs we place are a) fit for today and b) poised to lead future growth and innovation.

By partnering with Egon Zehnder, you gain access to a depth of expertise and a tailored approach that ensures your next CFO will be well-equipped to lead your financial strategy and support your organization’s growth objectives.

Explore our services to discover how we can support your financial leadership goals—and if you want to know more, get to know our expert consultants by browsing their biographies below.