In recent years, the role of the Chief Financial Officer has undergone remarkable growth in responsibilities. CFOs are wearing numerous hats and navigating diverse challenges on a day-to-day basis. To understand the evolving nature of the CFO role, Egon Zehnder recently published “The Super CFO,” a global survey of nearly 600 CFOs—finding that "Super CFOs" are emerging to tackle new challenges, prioritize fresh initiatives, and aspire to higher leadership roles, including the CEO position.

In this article, we examine selected highlights from the survey, providing insights tailored to specific geographical regions, including Asia / Asian Pacific, Europe, Latin America, Middle East and Africa and North America.

Finding 1. The CFO role is bigger than ever before, impacting all facets of the role.

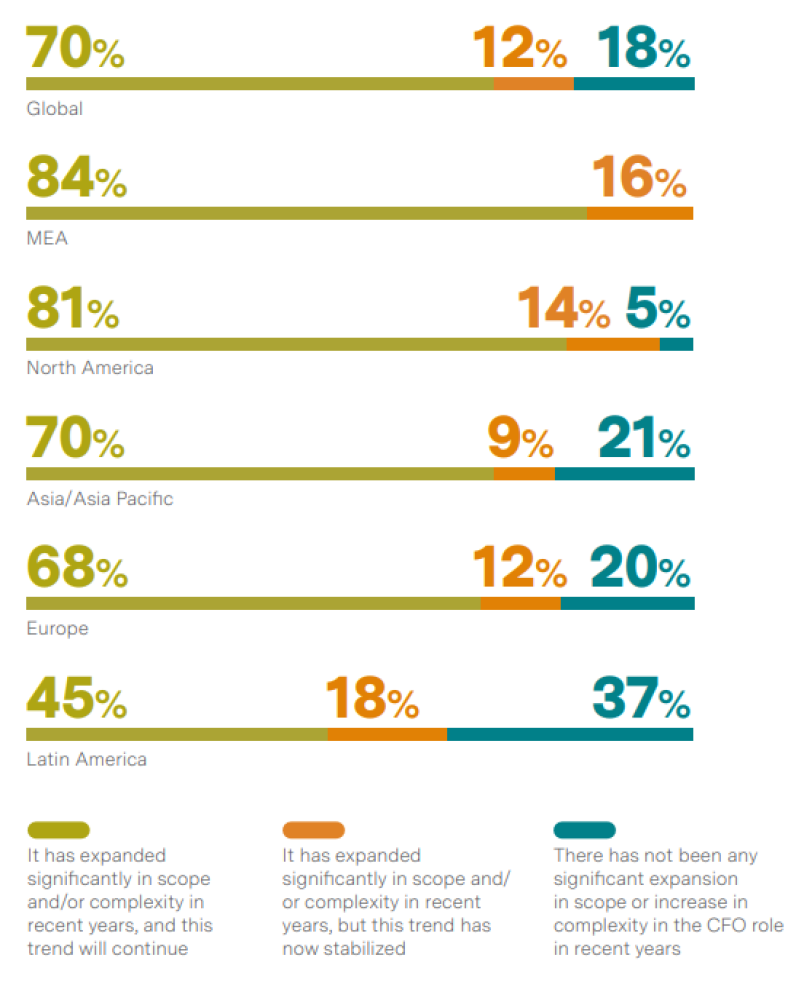

Our study revealed a significant trend: CFOs of nearly every region have seen the role expand in scope and/or complexity in recent years. For most, this trend is expected to continue, but there are some regional variances:

- All CFOs surveyed in the Middle East and Africa affirm the role has expanded. While 16% believe this trend has stabilized, most of them (84%) believe it will continue.

- Similarly, 95% of CFOs in North America say the role has expanded, and 84% believe it will continue to expand.

- Conversely, Latin America is the only region where a significant share of CFOs says the role hasn’t significantly grown (37%).

Which one of the following statements best aligns with your perspective on the CFO role?

As we will explore throughout this article, this discovery holds significant implications for every aspect of the CFO role—from achieving work-life balance, to attracting top talent, to future career aspirations (including rising to the CEO seat).

As a British CFO in the Consumer industry succinctly expressed: “The role and its demands are changing fast. I have been CFO for almost nine years, and the role is very different today to when I started. It is certainly more demanding, especially from the board and overall governance perspective.”

The New Technical and Leadership Competencies of a CFO

Examining the expansion of the role through a corporate responsibility lens, about half of CFOs have taken on ESG or M&A and Corporate Development responsibilities globally with minimal regional variation.

Equally, over the past two years, a new suite of leadership competencies has been integrated into their domain, making the role truly multifunctional and poised to spur meaningful change. Said one Italian CFO in the Healthcare and Pharma industry: “The CFO role can be the best role in the organization when combining co-leadership of the enterprise with the more technical and specialist sides.”

Globally, CFOs have undertaken risk management duties and co-leadership of the enterprise with the CEO, among other mandates. Looking to the future, this trend will continue.

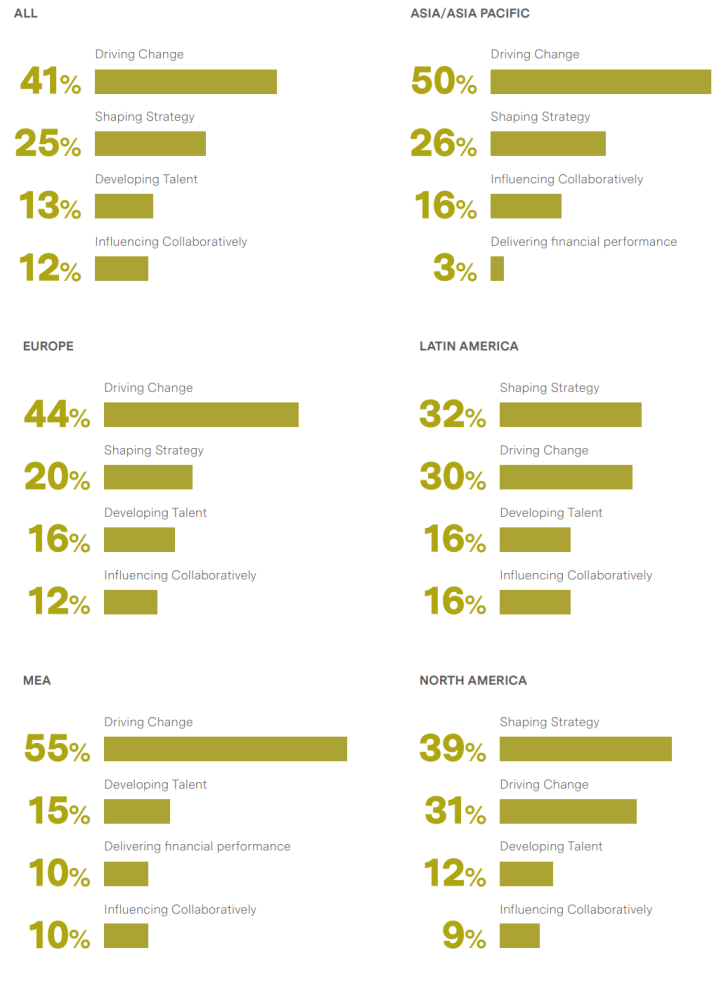

- On average, CFOs ranked driving change, shaping strategy, and developing talent as the most important competencies across regions.

- However, CFOs in Asia / Asia Pacific ranked influencing collaboratively as their top priority for the next five years.

- After driving change, CFOs from the Middle East and Africa elected developing talent and delivering performance as their second and third competencies that will matter, respectively—areas that didn’t stand out as much for CFOs in other regions.

A Dutch CFO in the Healthcare and Pharma industry echoes this sentiment of greater impact, sharing: "The driver of my career path going forward will be opportunity for impact and continuous learning."

Please select the competency that is most likely to increase in importance over the next five years, if any.

What areas CFOs would like to spend more of their time on

Reflecting on the actual and desired time they are able to allocate to core aspects of their role, CFOs acknowledged some gaps. Looking at the global findings, on average, CFOs would like to spend more time on strategy, developing finance talent, partnering with other business leaders, and capital allocation. Regionally, we found some noteworthy variances:

- For example, a significant share of CFOs in the Middle East and Africa region (63%) told us they would like to allocate more time to both finance talent development and strategy.

- North American CFOs would like to spend more time focusing on strategy (56%) and business partnering (51%).

- Across other regions, priority areas are more distributed, as the graphic illustrates.

Regarding the responsibilities CFOs would like to shed from their realm of responsibilities, on a global scale, are HR/talent, followed by IT, Supply Chain, and Cybersecurity. This trend was seen across regions.

Finding 2. Only one-fifth of CFOs say their work-life balance is poor.

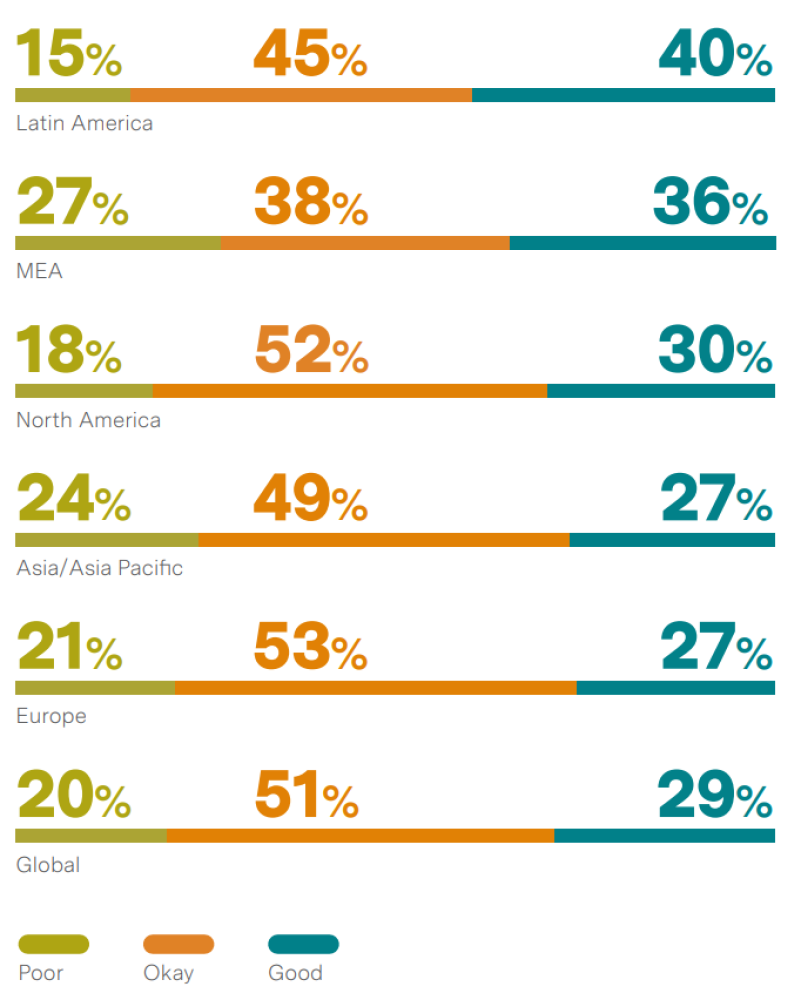

Despite the expanding workload and evolving role, the majority of CFOs in our survey globally rated their work-life balance as either "OK" (51%) or "good" (29%). Regionally, distinct trends emerged:

- Latin American CFOs exhibit the highest levels of satisfaction, rating their work-life balance as good (40%) or OK (45%). This could be attributed to the fact that a noteworthy share of them indicated that their role hasn't significantly grown.

- North American CFOs also have a favorable balance, with 30% rating work-like balance as good and 52% as OK.

- Conversely, CFOs in the Middle East and Africa reported the most unsatisfactory level of work-life balance, with 27% describing it as "poor."

Considering your responsibilities and commitments as CFO, how would you rate your current work-life balance?

Despite most CFOs claiming to experience a positive work-life balance, an Indian CFO in the Consumer industry offers a more cautious outlook: “The CFO’s role expectation has become that of an all-rounder nowadays. They are supposed to be a champion in numbers; be ears and eyes of the board and shareholders; a risk manager; and also stay on top on manufacturing and sales while contributing ideas with an eye on consistent growth.”

Expanding upon the personal strategic outlined by CFOs in our global report to mitigate the heightened expectations and responsibilities, we present below some additional tactics we heard from these executives:

Finding 3. Two-fifths of CFOs say it’s harder to attract top financial talent today than it was two years ago.

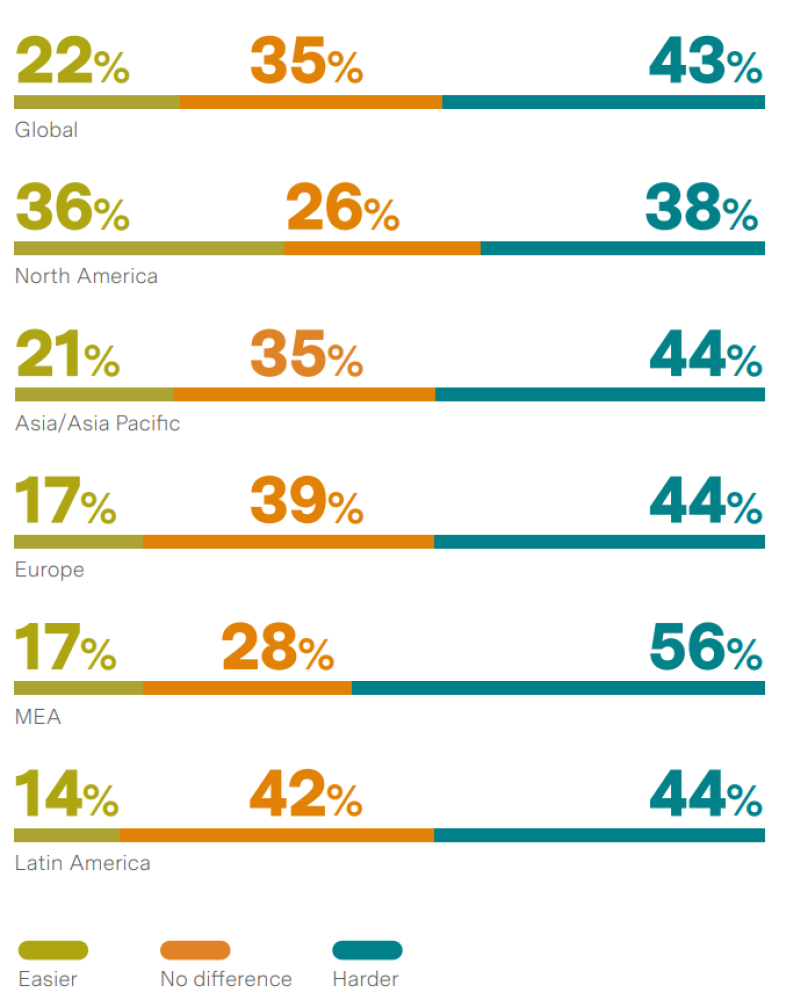

Layoffs, tough labor markets, increase in demands of roles, and skills gaps are some of the major reasons behind this struggle for talent, according to CFOs globally. But the challenge to attract financial talent varies by region.

- In the Middle East and Africa, 56% of CFOs believe it has become harder to attract top financial talent.

- In Latin America, CFOs are split. While there has been no difference in the past two years for 42% of them, 44% of CFOs report it has become harder.

- CFOs in North America have a similar conflict – 36% believe it has become easier to attract talent over the past two years while 38% think it has become more challenging.

Compared to two years ago, is it now easier or harder to attract top finance talent?

In our global survey, CFO respondents shared some intentional strategies they use to attract top employees:

- Raising the profile/reputation of their organization (British CFO, Consumer industry)

- Establishing a track record of strong financial performance (Indian CFO, Industrial sector)

- Embracing remote hiring (North American CFO, Healthcare and Pharma industry)

- Being at the forefront of the sustainability transition (Dutch CFO, Energy and Utility industry)

A strong finance team is also a good selling point for potential recruits. “Talent attracts talent—younger people want to work for top-tier managers,” a Netherlands-based CFO noted.

To build that bench of talent, CFOs shared that open and honest feedback was the most essential strategy, followed by rotating top employees into other parts of the finance department and ensuring employees have access to targeted development programs. Some of those individual development opportunities include growing or advancing IR capabilities, offering challenging work with support, empowerment to make decisions, and giving their teams both recognition and financial rewards for their work.

Finding 4. CFOs are being approached for new opportunities more often, but their main motivations for considering a new role aren’t driven by a larger company (neither by sales nor market capitalization) or higher compensation.

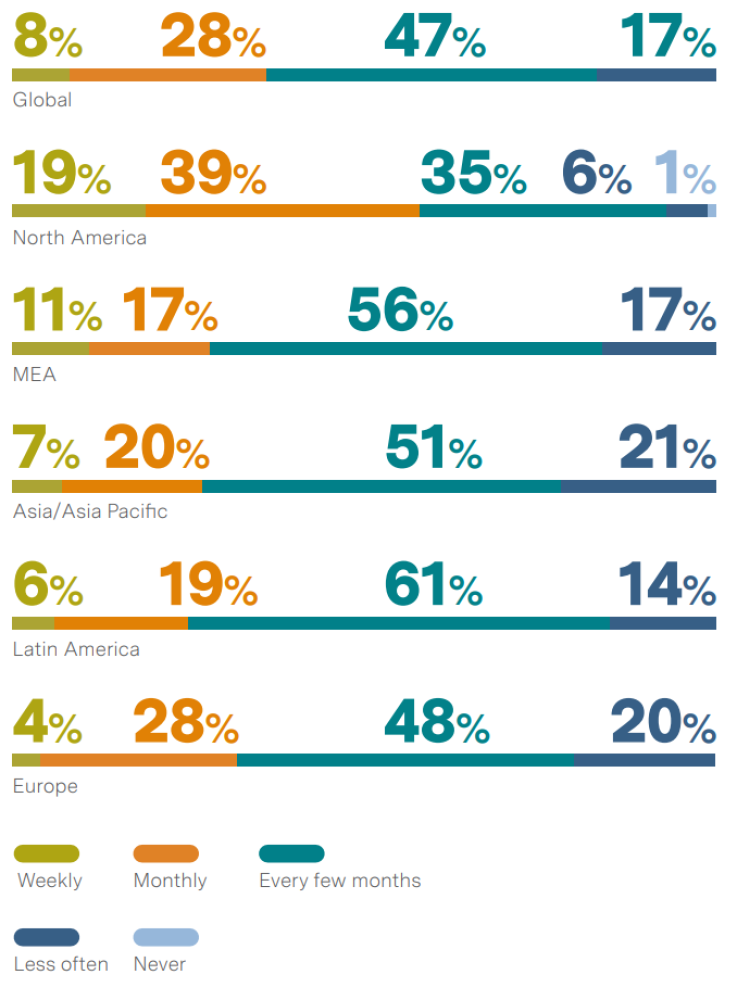

Globally, CFOs who reported being approached for new roles more often are being sought after every few months (47%), monthly (28%), and even weekly (8%).

- North America has the highest share of CFOs being sought after weekly (19%) and monthly (39%).

- Europe has the lowest share of weekly (4%), but a high share (28%) being approached monthly.

- Asia Pacific has the highest share of CFOs who are being approached less often (21%).

How often are you approached about new CFO opportunities?

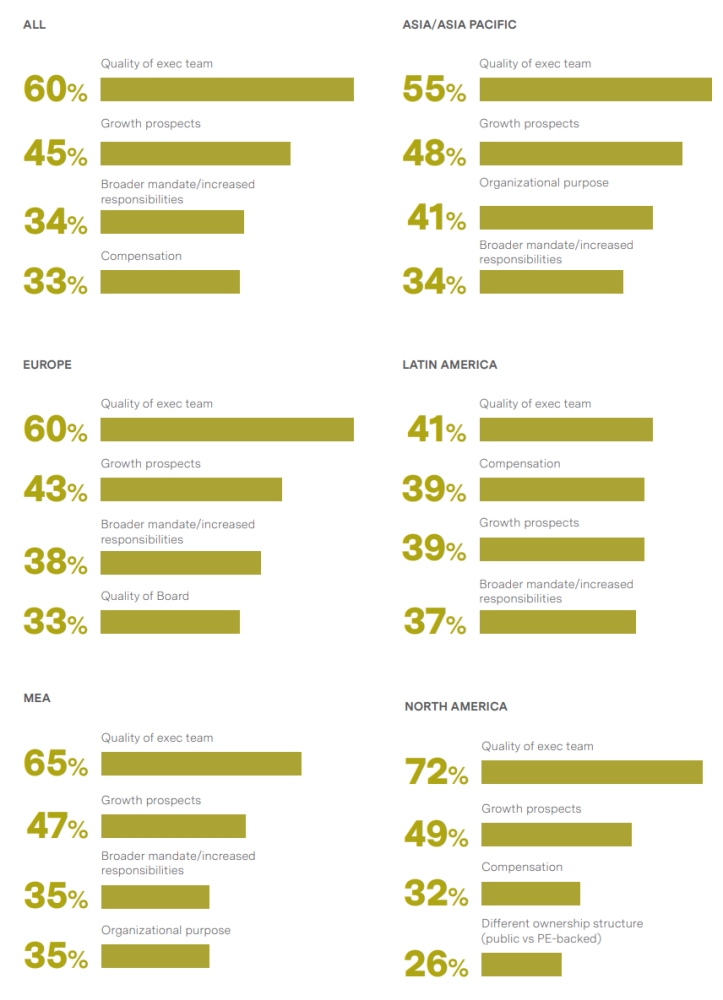

With growing competition for CFO talent, what sets a company apart, according to 60% of respondents globally, is a high-quality executive team as well as promising growth prospects (for 45% of respondents). Across every region surveyed, the same is true – particularly in North America, where 72% of CFOs noted this preference toward a high-quality executive team and growth prospects.

What factors are most important in deciding whether to pursue a new CFO opportunity?

The focus on who CFOs will work with over company size and revenue suggests that, if companies want to stand out in the competition for top talent, it’s imperative to be intentional about attracting and retaining enterprise leaders and their executive development.

Finding 5. Most CFOs aspire to be CEOs—either right now or in the future. But a few steps may remain to get there.

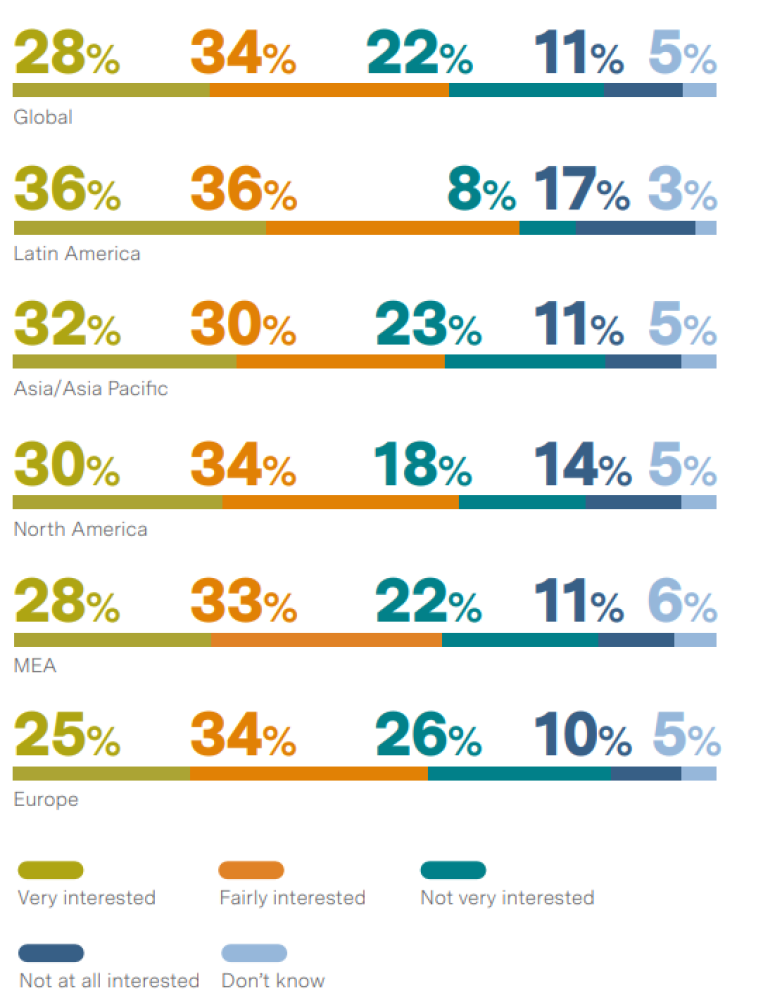

Our global survey found that 60% of CFOs want to be chief executives. Regionally, CFOs in Latin America stand out by displaying the highest level of interest (72%), followed by North America (64%), Asia / Asia Pacific (62%), Middle East and Africa (61%), and Europe (59%).

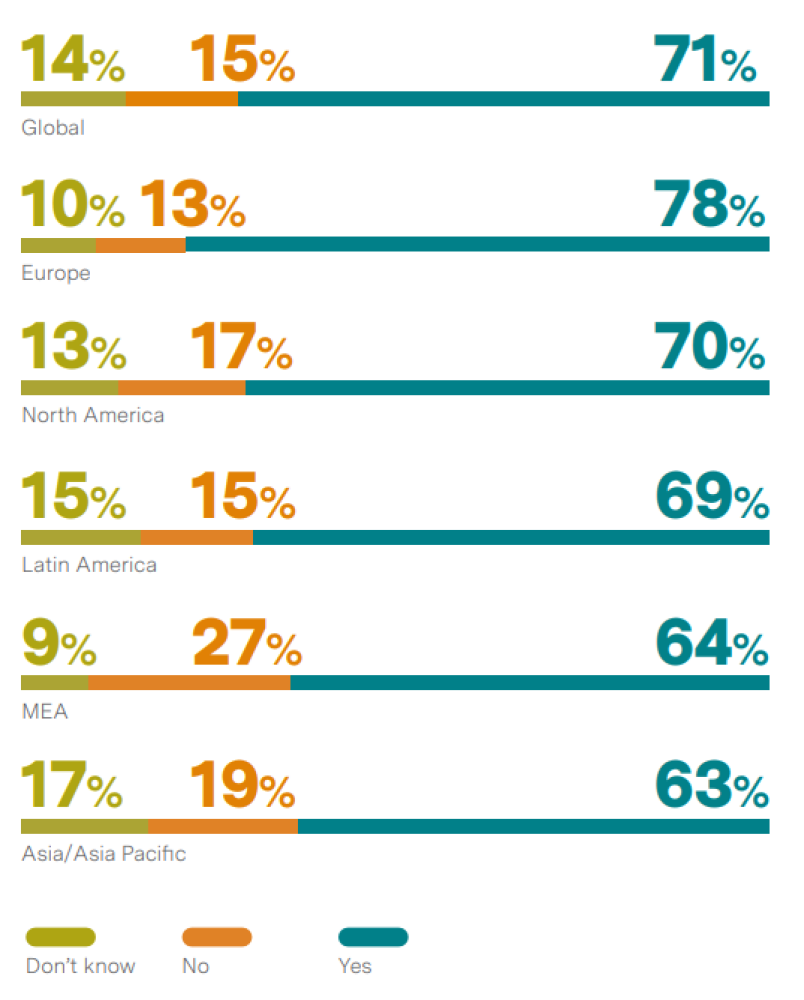

Interestingly, European CFOs have the highest share of CFOs who believe they are ready to become CEO now: 78%, above the global average of 70%.

To what extent are you interested in becoming CEO in either your current or future organization?

Do you feel ready for the CEO role?

But there are some hurdles to attain the top post. Nearly half (46%) of CFOs surveyed say networking and visibility is the biggest barrier to them becoming CEO, followed by customer and market knowledge and operational expertise.

At the regional level, CFOs in the Middle East and Africa, Europe and North America concur with those barriers. While in Latin America the top two biggest gaps are operational experience and strategic visioning—and the only region that mentioned communication skills as a key gap to becoming CEO.

At the same time, not every CFO aspires to be CEO. As one CFO put it, “[The duration of the role] has been 12 years in my case, and although I am proud of the achievements in that period, I ponder whether a change would be appropriate for my energy level.”

Learn More

Click here to read the global survey or download the global report PDF.

Learn more about our CFO Executive Search & Recruitment work or meet our consultants.