The Situation: Increased Complexity and Uncertainty

Innovation talent in the food and beverage industry has long been a key driver of top-line growth and margin expansion. Companies have been investing significantly in R&D to develop new products that align with the growing demand for healthier foods. The rise of functional foods—products that offer health benefits beyond basic nutrition—has been a game-changer. However, amid macroeconomic and geopolitical uncertainties, a more cautious stance on innovation is emerging.

As highlighted at this year's CAGNY conference in Florida, CPG companies are facing unprecedented disruption, from shifting regulations and accelerating wellness trends to cost volatility and geopolitical tensions. The market is in flux, as mergers between giants and consolidation of smaller players reshape the landscape. Agility is no longer optional—it has become essential for survival and growth. Many CPGs have opted to downsize, restructure, or pause investments—leading to a recalibration of innovation priorities. This signals a period of slower organic innovation at large-cap CPGs, with ripple effects across the industry.

"The market is in flux, as mergers between giants and consolidation of smaller players reshape the landscape. Agility is no longer optional—it has become essential for survival and growth."

Yet, this shifting landscape also creates openings for small- and mid-cap companies willing and able to take a longer-term view. While the path forward is not without its own challenges, these companies may find opportunities to attract top innovation talent and bring new products to market in ways that larger competitors, constrained by near-term pressures, cannot.

The Impact: Recalibrating the Innovation Agenda and Talent

Against this backdrop, we spoke to top innovation leaders across prominent F&B companies in North America to understand the impact not only on the innovation agenda, but also on innovation teams and talent. Across the board, we heard that companies are recalibrating their innovation priorities. Tightened budgets often force companies to prioritize short-term, incremental innovations over long-term, breakthrough projects—leaving innovation teams feeling demoralized. A primary concern is that high-performing innovation talent may gravitate toward more dynamic growth environments and leave the company.

F&B organizations are undergoing restructuring to streamline operations and reduce costs, involving merging departments, reducing headcount, or shifting focus to core competencies. In an effort to retain top talent, some F&B companies have downgraded, versus downsized, innovation talent. In some parts of its business, for example, a company has reduced Vice President-level roles to Director-grade roles, impacting short-term compensation and long-term incentives packages. More acutely still, companies significantly impacted by cost price volatility, such as in the cocoa market, have needed to lay off innovation talent. Such changes can affect organizational culture, potentially leading to decreased employee morale and productivity.

The industry is also feeling the squeeze of consolidation with increased large-scale merger activity, which in several cases has caused restructuring and rationalization of innovation teams. These activities could drive innovation talent to seek roles at smaller, nimbler companies, which will bet on build vs. buy growth strategies, or leave the F&B sector entirely. As employees seek competitive compensation, job security, and growth environments, the immediate focus on addressing cost management and supply chain stability may undermine a company’s ability to stay competitive for innovation talent in the long run.

The Opportunity: Innovation Talent for Small- and Mid-Cap F&B Companies

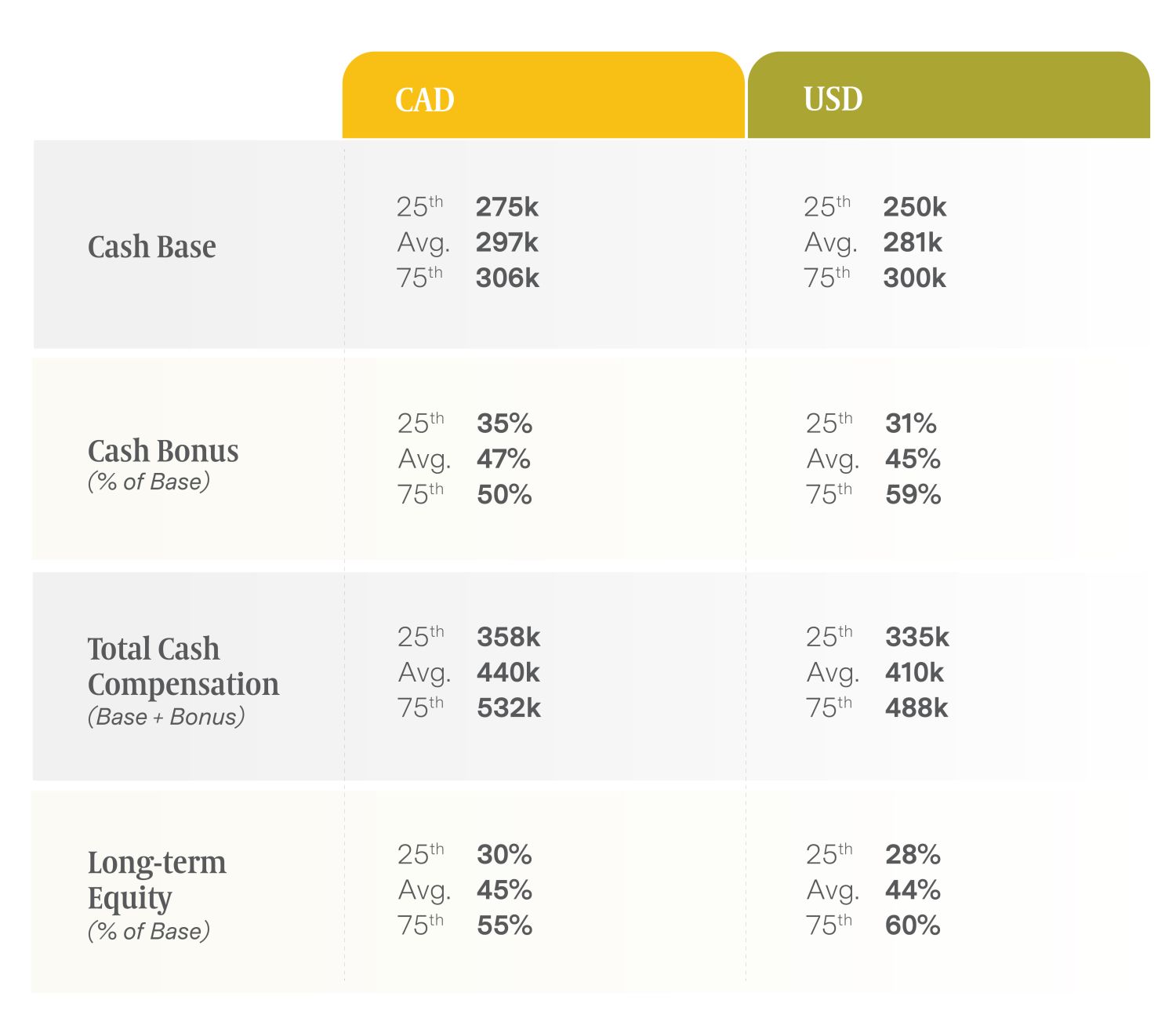

It’s a buyers’ market right now for innovation talent, and a unique opportunity for small- and mid-cap F&B companies to recruit top talent at a lower cost. Below is a table of recent compensation benchmarks across both the Canadian and U.S. talent markets.

Source: EZ Database n=25 as of Q1 2025 Benchmarks

The complexities of the current environment undoubtedly weigh heavily on leadership teams, and navigating these pressures is far from straightforward. While short-term challenges are numerous, there are areas where companies can find opportunities to strengthen their position. Amidst economic pressures, some companies—particularly those with financial stability—may find themselves in a unique position to attract top-tier innovation talent. In contrast to large, global competitors struggling with these same pressures, smaller, more specialized companies, both branded as well as in private label, could become attractive to professionals seeking both stability and a more dynamic, less bureaucratic environment.

"Amidst economic pressures, some companies—particularly those with financial stability—may find themselves in a unique position to attract top-tier innovation talent."

Winning requires top talent that can balance operational efficiency with strategic growth. The challenge here is to deliver market leading innovations while operating with a leaner structure compared to the bloated SG&A models of the large MNCs. Success hinges on creating a lean structure that is well integrated into the existing operating model and selecting innovation talent who can adapt to and thrive in this context.

The key capabilities that differentiate parlor generals from field generals include:

- Leading innovation: Effective innovation leaders can not only create the environment for innovation to happen, but also build the organization’s competencies to develop and execute it. As a driver of an innovation culture, they are able to foster and enable out-of-the-box thinking, to encourage others to challenge traditional ways of doing things, and to promote psychological safety so that failures can happen. As an executor of innovation, the best leaders have demonstrated an ability to secure adequate resources in constrained environments, to allow teams to execute experiments, and to decisively select and scale the best ideas.

-

Driving commercial outcomes: The innovation leaders who will be able to transition from large cap to a nimbler player are energized by seizing chances to increase profit and revenue. They create new and better means to achieve customer and consumer success and measure their success in financial terms. That doesn’t mean they take their eyes off Horizon 2 and 3 breakthrough innovations, but it does mean that they drive relentlessly for results in the short term, and look for creative pathways, whether through open-innovation, AI, or partnerships, to achieve longer-term success. -

Influencing collaboratively: One might argue that stakeholder management is easier at relatively smaller scale, flatter companies, however you’d be underestimating the stakes at play. Sure, there may be fewer key decisions makers, but they are likely in positions of more authority, including Board Directors and large-reference investors. Effective innovation leaders in this context demonstrate an ability to cut through complexity by communicating simple and compelling messages that galvanize an organization behind a unified innovation imperative.

While these talent shifts are not easily orchestrated, companies that prioritize a supportive culture and work environment can position themselves as the employer of choice. In an environment where every decision carries weight, identifying the right opportunities at the right time is key. Companies must carefully balance talent acquisition, sustained innovation, and strategic collaborations—not as isolated priorities but as interdependent levers that shape resilience and long-term competitiveness. There are no easy answers; the trade-offs are real, and the risks of overextending or underinvesting are high. Yet, for those who can align short-term constraints with a long-term vision, the ability to not only withstand uncertainty but emerge stronger remains within reach.