What Traits Do Successful Family Controlled Companies Commonly Hold?

Family controlled companies hold a unique and powerful position in the global market.

According to a 2022 report by Family Capital, the 750 largest family businesses collectively generate over $10 trillion in revenue, employ millions of people, and span nearly every industry imaginable. From the Walton family of Walmart fame to the Mars family’s confectionery empire, these businesses dominate industries while passing on values and wealth across generations.

However, their widespread influence and long-standing histories don’t make them immune to challenges.

Family controlled companies often face unique complexities – governance, succession planning, family dynamics, and resistance to change – that can threaten their sustainability.

Join us as we explore the top family controlled businesses, the traits that contribute to their success, and actionable insights to help family firms thrive long-term.

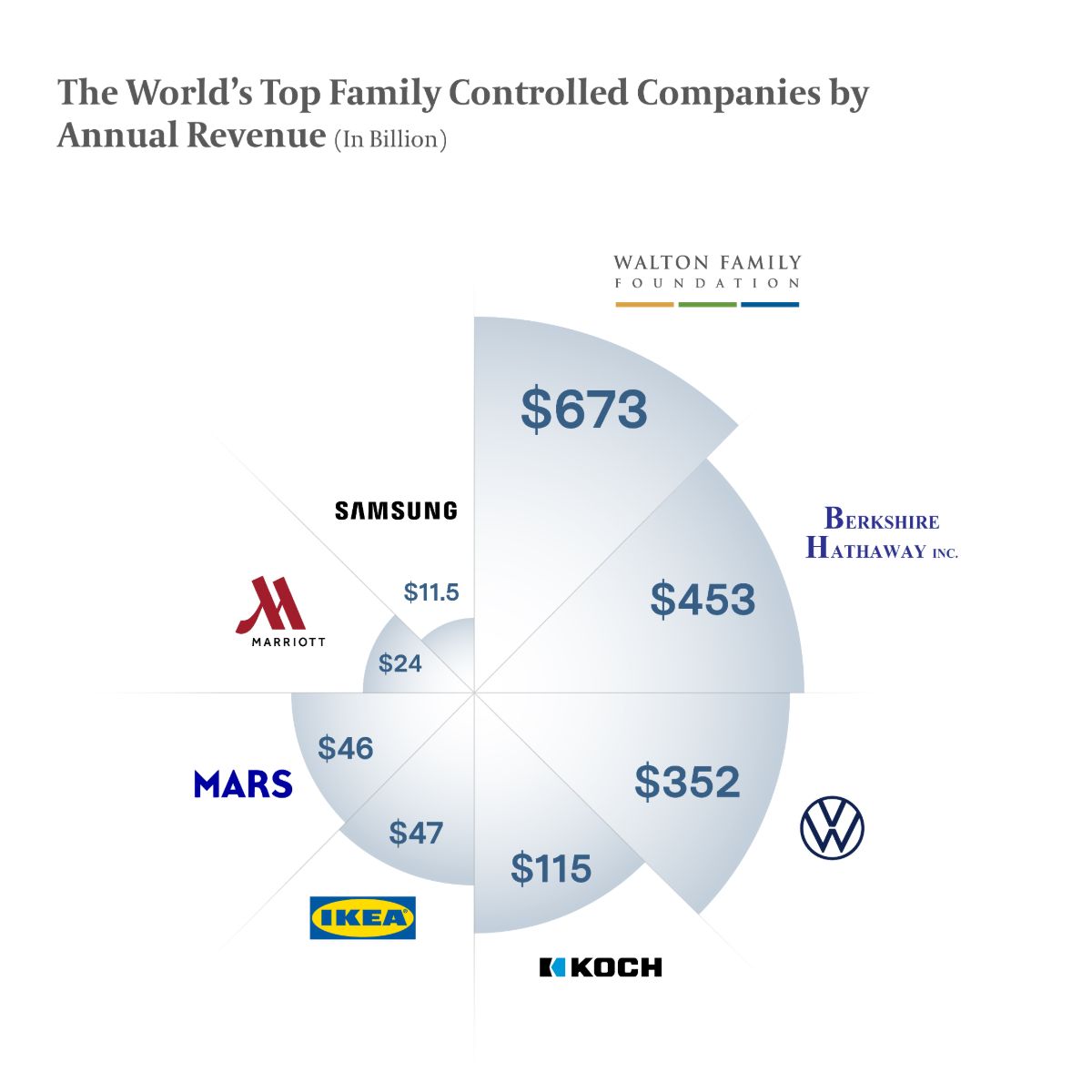

The World’s Top Family Controlled Companies by Revenue

Family controlled companies are responsible for some of the world’s most well-known and successful brands – some that you likely use every day and may not know are family owned companies.

Most people think of the Walton family (founders and owners of Walmart) as the biggest family business in the world – and they would be right. The retail giant generates $673 billion in annual revenue.

But there are many more examples, including:

Volkswagen AG

The German automaker remains under the control of the Porsche and Piëch families and continues to lead in automotive innovation. The automaker’s annual revenue corresponds to $351.876 billion annually.

Berkshire Hathaway

Founded and owned by the famed Warren Buffet, Berkshire Hathaway is an American household name, known for its success in holdings. Originally founded as a textile manufacturer, the company now brings in $453 billion each year.

Marriott

After bouncing back from the pandemic, the Marriott family-owned-and-operated hotel giant is now bringing in $23.71 billion annually.

IKEA

Founded by Ingvar Kamprad in 1943, IKEA is now a multi-billion dollar business that sells flat-pack furniture. The empire remains firmly rooted in family values despite its global expansion and brings in $46,6 billion annually

Mars Inc.

The Mars family oversees this food company powerhouse, maintaining strong traditions and a long-term view in business strategy. The company owns and operates some of the world’s most renowned confectionary and pet food brands. Annually, they bring in $46 billion.

Samsung

Samsung is a South Korean tech giant, controlled by the Lee family. It’s considered a leading innovator in electronics and semiconductors. Lee Jae-yong, the living heir and current executive chairman of Samsung, is worth $11.5 billion.

Koch Industries

Headquartered in Kansas in the United States, the Koch family runs and operates Koch Industries, one of the largest agricultural product businesses in the world. Annually, the company makes $115 billion in revenue.

In addition to these companies, notable mention goes to the Cartier Family (Cartier), the Quandt family (BMW), the Botín family (Santander Bank), and the Ford Family (Ford Motor).

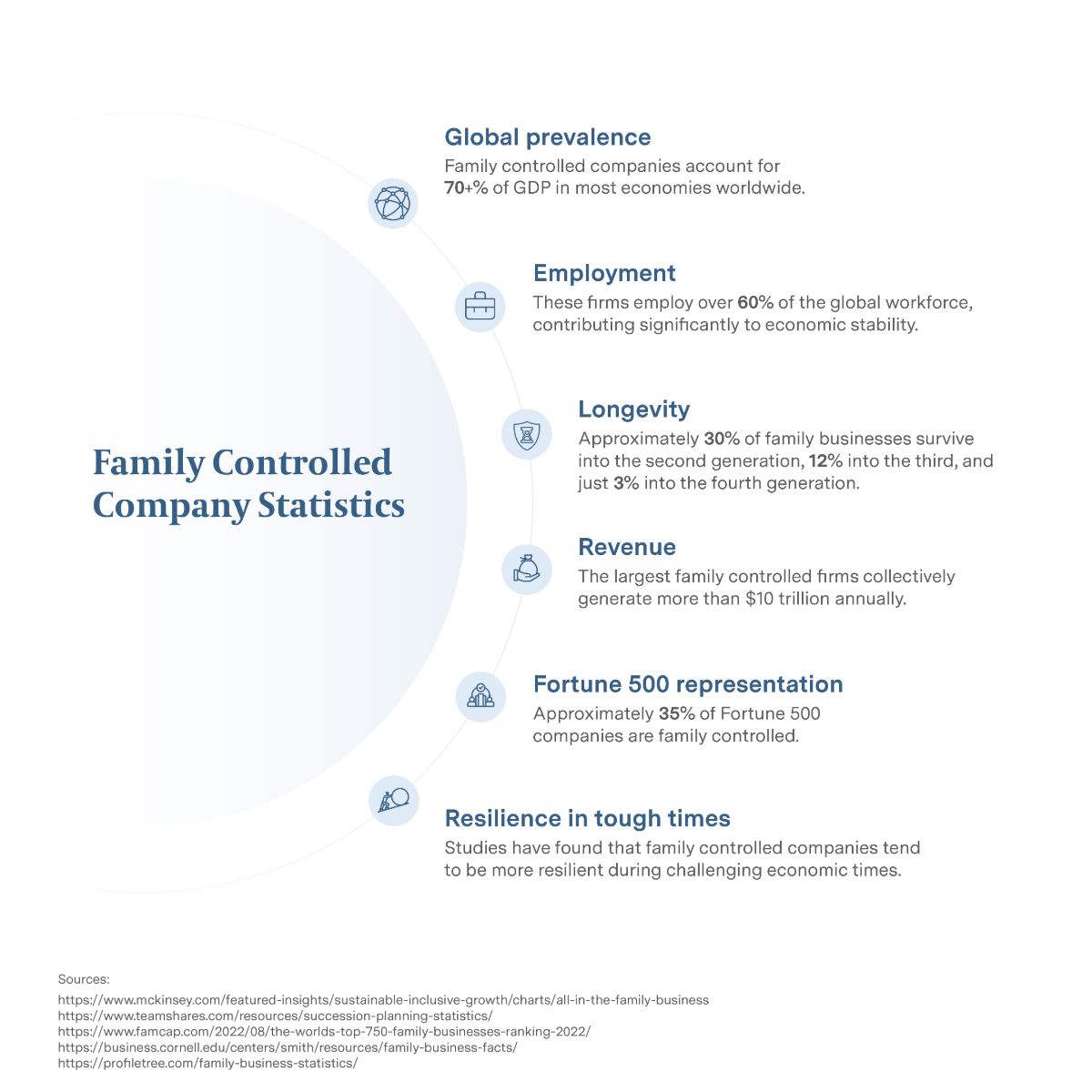

Family Controlled Company Statistics

Family owned companies make up a significant portion of the global economy and provide jobs to a huge percentage of citizens around the globe.

Let’s review some key statistics that illustrate their international impact and highlight the immense economic footprint of family businesses:

- Global prevalence: Family controlled companies account for 70+% of GDP in most economies worldwide.

- Employment: These firms employ over 60% of the global workforce, contributing significantly to economic stability.

- Longevity: Approximately 30% of family businesses survive into the second generation, 12% into the third, and just 3% into the fourth generation.

- Revenue: The largest family controlled firms collectively generate more than $10 trillion annually.

- Industry spread: These businesses span every sector, with significant concentrations in retail, manufacturing, and financial services.

- Fortune 500 representation: Approximately 35% of Fortune 500 companies are family controlled.

- Resilience in tough times: Studies have found that family controlled companies tend to be more resilient during challenging economic times.

Why Family Controlled Businesses May Be Successful

Family controlled businesses often succeed because of traits rooted in their long-term vision, strong values, and ability to foster loyalty among employees and customers.

However, their success is never guaranteed.

Longevity requires balancing tradition with innovation, strong governance, and effective leadership.

To stick around, these companies must inherently have:

A Unified Long-Term Vision

One hallmark of successful family businesses is their focus on long-term growth rather than short-term gains. Unlike publicly traded companies beholden to quarterly earnings, family firms often prioritize sustainable growth, reinvestment, and resilience. This long-term mindset allows them to weather economic downturns and adapt to shifting market conditions.

Governance Structures

Effective governance is critical to maintaining alignment between family and business goals. Successful family businesses often establish clear governance structures, such as family boards, advisory councils, or family charters, to separate family dynamics from business decisions. These structures ensure accountability, reduce conflict, and provide a framework for addressing evolving priorities across generations.

Governance is the DNA of a family business. Clear responsibilities, alignment of principles, and structures like family offices or family boards help separate family decisions from business decisions while keeping both linked in a healthy way.

An Egon Zehnder consultant who advises family businesses on governance, succession and talent management. Tankut serves as the leader of Egon Zehnder’s UK Family Business Advisory.

Strong Succession Planning Processes

Succession planning is a critical factor in the longevity of family businesses. Companies that thrive through generational transitions identify and prepare future leaders well in advance. This process often involves assessing whether leadership roles are best filled by family members or external professionals and ensuring that transitions align with the company’s long-term vision.

Leadership in family businesses often requires a delicate balance between family and professional capabilities. The oldest or most senior family member isn’t always the right person to lead. Sometimes, an external leader is needed to meet the evolving demands of the business.

An Egon Zehnder consultant who advises family businesses on governance, succession and talent management. Tankut serves as the leader of Egon Zehnder’s UK Family Business Advisory.

Strong Family Culture and Values

Values form the foundation of many successful family controlled businesses. These principles often guide decision-making, build brand loyalty, and create a sense of shared purpose among employees. For example, Marriott’s commitment to customer service and Walmart’s focus on humility and frugality have been integral to their success.

Nearly every family business is founded on a solid culture and values – these are often the foundation of their success. However, times do change, and businesses must adapt. Striking the right balance between maintaining core values and embracing change is critical. It’s like taking medicine: too much, and it’s poisonous; too little, and you won’t heal.

An Egon Zehnder consultant who advises family businesses on governance, succession and talent management. Tankut serves as the leader of Egon Zehnder’s UK Family Business Advisory.

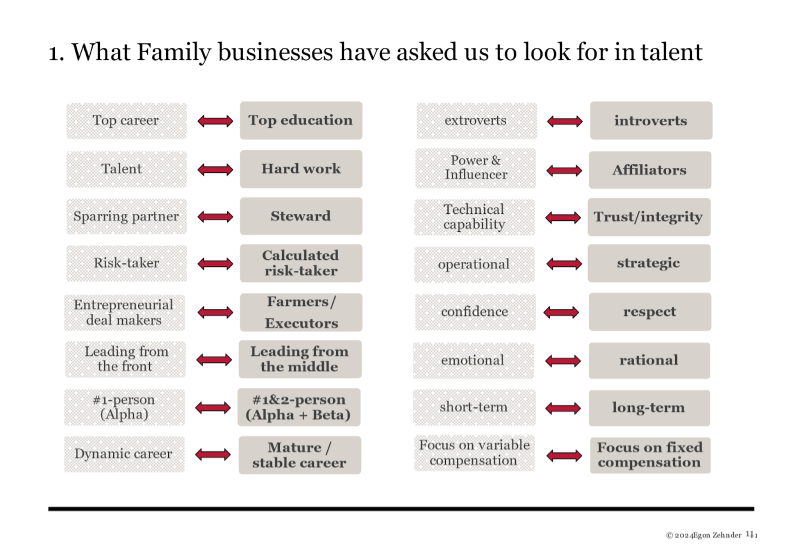

Attention Paid to Talent

When working with family controlled companies to hone their talent processes, there have been several key competencies that our clients have asked us to explore, ensuring that candidates are assessed with a 360-degree view. Some of those competencies are outlined in the graphic below.

Adaptability to Change

While strong values are essential, the ability to adapt is equally critical. Businesses that strike a balance between preserving their core identity and embracing innovation are more likely to thrive. For example, the Mars family continues to expand its portfolio into pet care and health while retaining its legacy in confectionery.

Expanding beyond domestic markets brings new pressures. Family businesses must adapt their ways of working and avoid getting stuck in their home culture to succeed in global markets. Further, family businesses often have strong cultural foundations that make them successful, but these values shouldn’t hold them back from adapting to market changes. Identifying which values to preserve and where to evolve is essential for long-term success.

An Egon Zehnder consultant who advises family businesses on governance, succession and talent management. Tankut serves as the leader of Egon Zehnder’s UK Family Business Advisory.

Family Dynamic Management

Family controlled companies face a unique challenge that sets them apart from non-family businesses: managing complex family dynamics.

These dynamics are not only rooted in personal relationships but also in the overlapping roles family members play within the business. Successfully navigating these relationships is critical for preserving harmony, fostering collaboration, and driving sustainable growth.

Family dynamics can significantly influence the direction and success of the business. When well-managed, they can be a source of strength, offering a foundation of trust, shared values, and long-term vision. However, if left unchecked, they can create conflict, destabilize leadership, and hinder the company’s ability to make sound decisions.

In family controlled companies, individuals often wear multiple hats: they are family members, shareholders, and sometimes executives. Each role comes with its own set of expectations and responsibilities, which can sometimes conflict. For example, a sibling working in the business may expect loyalty as a family member while being evaluated on performance as an employee. These blurred lines can create misunderstandings and tension.

To prevent conflict and maximize the benefits of family relationships, businesses need a structured approach to managing dynamics:

- Clear governance structures: Establishing a family council or governance board ensures there is a forum for family members to address concerns, define roles, and align on priorities separate from business operations.

- Defined roles and responsibilities: Every family member involved in the business should have a clearly defined role based on merit, not birthright, to foster professionalism and accountability.

- Transparent communication: Open dialogue is crucial for resolving disagreements before they escalate. Regular family meetings can help address issues and maintain alignment on the company’s direction.

- Coaching and mentorship: External advisors or coaches can help family members navigate conflicts, improve leadership skills, and adapt to changing responsibilities.

- Conflict resolution mechanisms: Establishing clear protocols for resolving disputes – such as mediation or arbitration – can minimize the impact of disagreements on the business.

Family dynamics can either strengthen or undermine leadership in family businesses. Professionals and family members alike must understand and adapt to these dynamics. Leaders need to know how to shift their identities – balancing their family role and professional responsibilities.

An Egon Zehnder consultant who advises family businesses on governance, succession and talent management. Tankut serves as the leader of Egon Zehnder’s UK Family Business Advisory.

Where do Family Businesses Turn for Help?

While family businesses have many advantages, they also face unique challenges that can hinder growth, longevity, and harmony. Issues like internal conflicts, lack of succession planning, and resistance to change often require outside expertise to address.

As family businesses grow, it’s inevitable that family members alone can’t meet all the capabilities required. Hiring external professionals, aligned with the family’s culture and values, can bring the expertise needed to navigate growth and complexity. With this, family businesses have become more open to working with consultants as they mature and face transitions. Consultants bring benchmarks, conflict resolution strategies, and creative solutions to complex challenges, helping families balance business goals with emotional dynamics.

An Egon Zehnder consultant who advises family businesses on governance, succession and talent management. Tankut serves as the leader of Egon Zehnder’s UK Family Business Advisory.

Egon Zehnder specializes in helping family controlled companies navigate these challenges for long-term success. From building governance structures to identifying future leaders and fostering alignment among stakeholders, Egon Zehnder’s tailored approach ensures family firms are positioned for long-term success.

To learn how Egon Zehnder can support your family controlled business in achieving sustainable growth and enduring success, contact us today. Our experienced consultants provide the insights and strategies needed to unlock the full potential of your family enterprise.