Over the past couple of decades, traditional financial institutions and service providers have gradually found themselves in the midst of an entirely new and continuously evolving competitive landscape. Facilitated by rapid and extraordinary advances in modern technology, the rise of digital services and new players from the burgeoning fintech and insurtech sectors has not only led to increased optionality for customers but has also given birth to a range of novel use cases and a veritable reimagining of how customers interact with financial products in the digital age.

To better understand the current trajectory of the alternative financial services landscape and, most importantly what this means for traditional banks and providers across the globe, Egon Zehnder’s Directors Development Program held a session with Hemant Jhajhria, career digital strategy expert and current Managing Director and Partner with Boston Consulting Group. Throughout the session, Hemant helped shed light on everything from the inherently disruptive nature of modern data and the importance of building around customer experiences to how an era of rapid innovation and evolving consumer expectations is shaping the future of financial products and services.

A New Reality

Until the fairly recent surge of alternative providers entering the scene, a handful of large banks and legacy institutions had enjoyed largely uninterrupted dominance over the global financial services sector. However, in order to understand why this advantage appears to have eroded considerably over time, it helps to first understand how traditional banks were so effective at cornering the market in the first place.

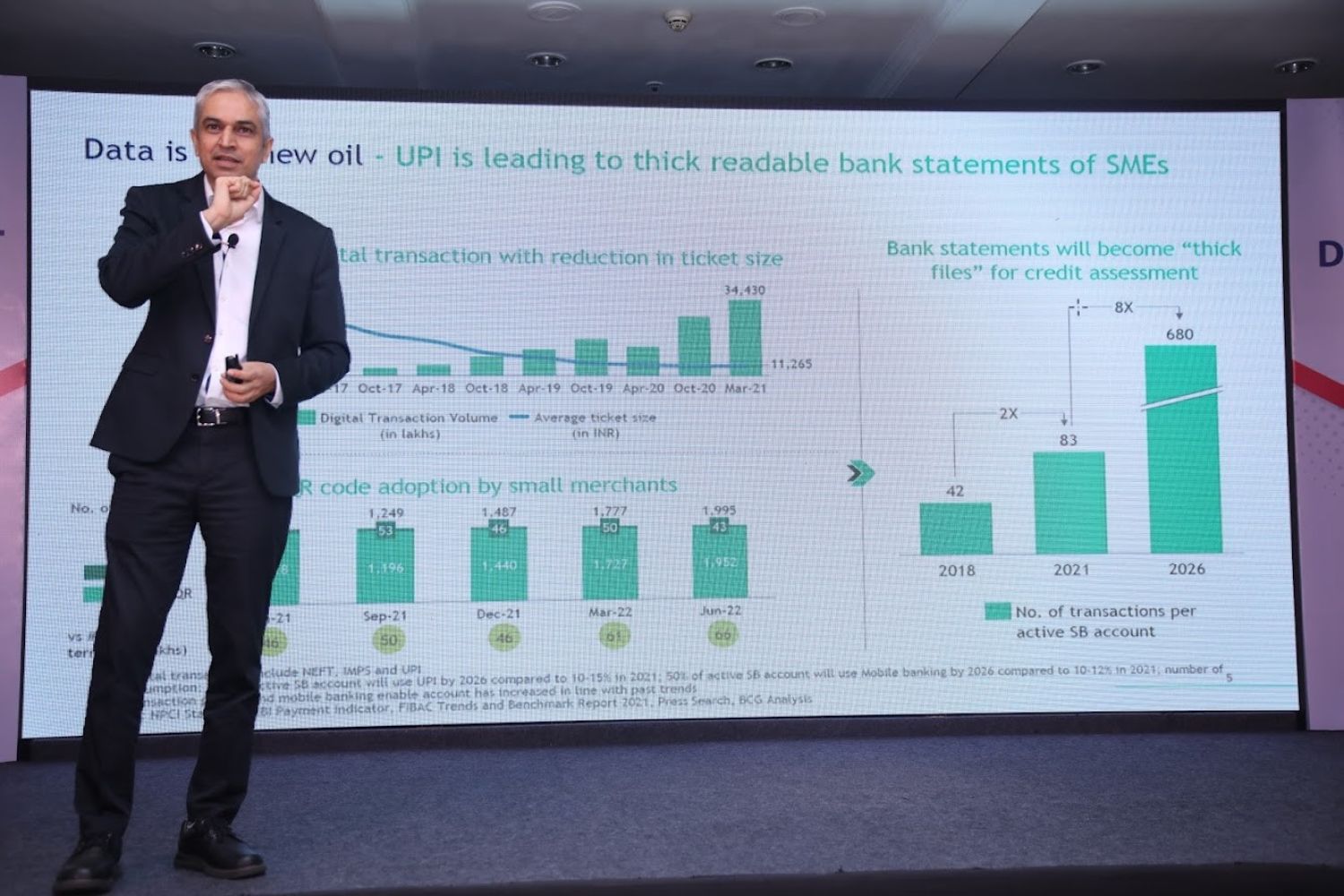

The answer, according to Hemant, is data. “Historically, banks have always had a monopoly on [financial] data,” he said. “If you wanted to give credit, only banks had the data needed to make that happen, nobody else.”

More than simply owning financial data, however, Hemant notes that banks have made it notoriously difficult to access, with various categories of data being segregated and controlled by different branches, resulting in a frustrating and tedious experience for customers in need of financial services and products. And because banks have maintained such a powerful stronghold over information for so long, customers have found themselves going from branch to branch, collecting document after document in the absence of a more efficient process.

But as personal data has begun to migrate into the possession of the consumer, Hemant believes that traditional banks and financial services providers may be witnessing the beginning of the end of unchallenged market dominance.

“I think that mindset needs to change,” he said, alluding to the notion that customers will continue to endure poor experiences despite taking control of their personal information. “Because today who is going to own the data? The customer is going to own the data. We can see every single country moving in that direction. And when the customer owns the data, they can make it available to whomever they want to. That’s the new reality.”

The Value Proposition of Experience

According to Hemant, another major reason that traditional service providers may be slowly losing business to their fintech competitors is their failure to understand “the value proposition of experience,” particularly as it relates to meeting customer demands in the digital age.

More specifically, Hemant points to the growing popularity and prevalence of mobile payment applications, such as Google Pay (GPay) and PayTM. By building out a front-end product designed to optimize user experience while still leveraging banks as backend manufacturers, such applications have managed to captivate the minds of consumers to the point that they no longer associate the process of sending and/or receiving payments with traditional financial institutions.

“When you think about payments today, who do you think of?” Hemant mused. “You think of GPay, PayTM, maybe even a company like WhatsApp in a few years’ time. But who you don’t think of is a bank.”

In other words, in addition to losing actual business to fintech providers, banks and other traditional service providers are losing out on customer recognition and, most importantly, relationships.

And in Hemant’s view, if financial institutions hope to become anything more than the provider of a balance sheet in the eyes of consumers, they will need to learn to design new digital products and experiences around the unique demands of modern consumers, as opposed to repurposing existing technology to keep up with the latest trends.

“You have to start with the customer if you want to make a difference,” he said. “What Google or WhatsApp are doing, banks can do as well. But you have to start from customer experience. You have to start by thinking about what the customer actually wants.”

Of course, knowing what the customer wants can be a challenge in itself, however, this is why it’s become so critical to leverage customer data as effectively as possible, and in a way that generates increasingly valuable insights into their behaviors and preferences. And this, according to Hemant, is also why fintechs and large tech corporations have become such strong players in the finance sector; by utilizing data alongside machine-learning technology and even generative artificial intelligence (AI), alternative providers now have the ability to constantly expand everything from the range of financial products and services being offered, to the metrics against which an individual’s credit is being evaluated.

“Ultimately, it’s about universe expansion,” said Hemant. “Machine readable data [using tools like Gen AI] removes the need to manually assess each account, and instead automatically generates insights from available data. And this is the reason that fintechs have become so powerful.”

The Future is ‘Embedded’

Finally, when speaking to the future of financial services, including the path most likely to be taken by emergent fintech and insurtech players, Hemant said he believes that service providers will be almost exclusively focused on embedded products. More specifically, in defining the term “embedded finance," Hemant circled back to the idea that modern consumers, and certainly the next generation of consumers to come, will simply no longer be willing to go out of their way when it comes to managing their finances or even getting insurance on major purchases.

“What does embedded finance mean? As a customer, it means I keep leading my life the way I want to lead it. It means banks make an effort to embed their services into my life as it is, rather than asking me to jump through hoops, come into their branch, make five trips and fill out a new form for each visit. And if banks don’t make that happen, I can tell you right now that the next generation is not going to make those five trips to the bank branch. Because believe me, they will have other options,” Hemant said.

Hemant went on to note that the same principle applies to the insurance sector, and went so far as to call embedded insurance the “next frontier” for the industry. Far from being controversial, this is exactly the kind of thing we have already seen happen time and time again in the age of digital commerce, whether it’s adding insurance to a ticket purchase, or even securing a short-term personal loan. Moreover, with the help of machine-learning, creditors will be increasingly capable of making accurate determinations on the spot, and in turn doing away with the need to lure customers away from their daily routines.

“Customers don’t want to come in and apply for separate loans, you have to be able to do it there," he said. “And with embedded finance, all it will take is providing a customer with the option, and then in two clicks you’ll be able to look at their credit score and offer a loan right there on the spot.”

At the end of the day, Hemant envisions a future in which providers of all disciplines across the financial services sector begin to truly appreciate the value of leveraging technology and data effectively, and above all begin to view these tools and processes as a way to establish their offerings as more than financial products, but as casual features in the daily lives of consumers around the world. “This is exactly what’s on the mind of all the tech players today,” he said. “You have to learn to insert yourselves into customers’ lives.”