China’s medical technology (medtech) industry has grown rapidly over the past decade, driving bold innovations in diagnosis and treatment. It has played a key role both in improving China’s health outcomes and supporting the country’s economic progress. The industry, worth $70 billion in 2021, is expected to grow to between $110 billion and $165 billion by 2030. Chinese subsidiaries of global multinationals (MNCs) have played a leading role in the industry’s growth—yet locally-owned companies have stepped up too and have increasingly gained market share.

Today, however, the industry faces a slower economic environment and greater complexity, which calls for adaptiveness and fresh thinking from senior executives. But companies are struggling to find the next generation of leaders. They will need to cast the net wider, looking beyond the industry to access diverse, high-potential talent who bring new perspectives and a broader skill set. At the same time, companies will need to equip existing medtech executives—many of whom have spent decades in the industry—with leadership capabilities that are relevant for changing times.

These leaders, both emerging and established, will need to rise to the occasion, as China’s medtech companies—particularly MNC subsidiaries—face a complex set of interlocking challenges. New emphasis on cost-effective healthcare and the falling prices of medical devices are putting pressure on companies’ profitability, while increasing competition from local firms is limiting international players’ revenue growth.

For leaders of MNC subsidiaries, there are also new challenges in their relationship with head office. Previously, MNCs regarded their Chinese subsidiaries as a priority market, executing on a globally agreed strategy. Now, the relationship between many local subsidiaries and their multinational owners has shifted from mutual support to increased decoupling. Chinese leaders of MNC subsidiaries must now shape “China for China” strategies, business models, capabilities, and stakeholder relations—while managing far-reaching change in their organizations and sustaining trust with global headquarters.

The shortage of leadership talent—and the need for diversity

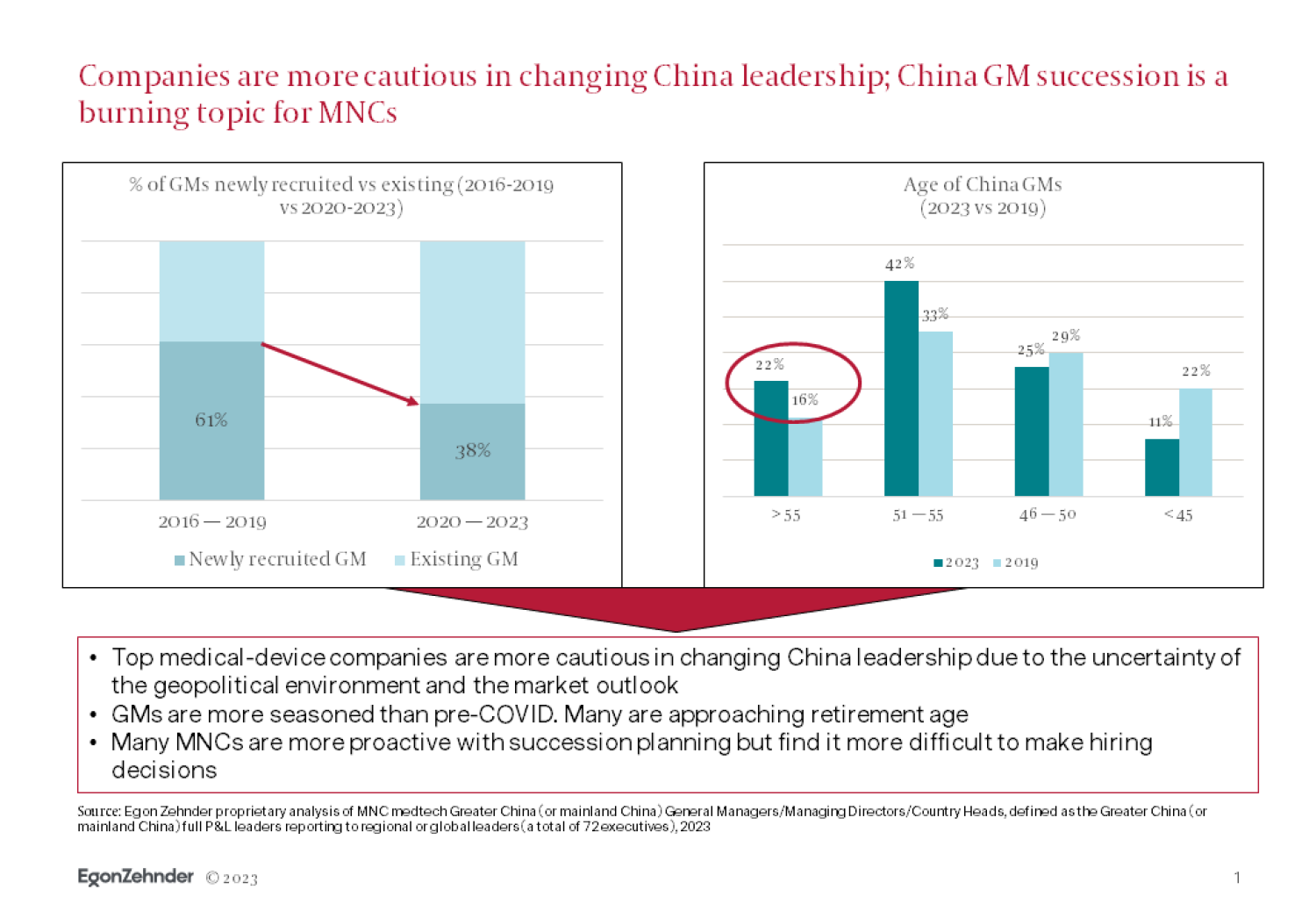

Just as the demands on leaders are increasing, China’s medtech companies face a shortage of candidates. In the face of this talent squeeze, many MNCs have adopted a more cautious approach in selecting their China general managers (GMs), with many opting to keep their current China GM. In the period between 2016 and 2019, approximately 61 percent of medtech companies replaced their China GMs within three years. Since 2020, however, this figure has declined to 38 percent.

This slowdown in GM turnover is reflected in an aging leadership profile. In 2019, fewer than half of China GMs were older than 50. But in 2023, only two-thirds were—of whom 22 percent were over 55 and approaching retirement age. Over the same period, the proportion of GMs younger than 45 fell by half—to just 11 percent in 2023. These figures do not reflect a failure to conduct succession planning, for which most companies have robust processes in place. Rather, the problem is a scarcity of suitable leadership candidates, which makes it harder for companies to make hiring decisions.

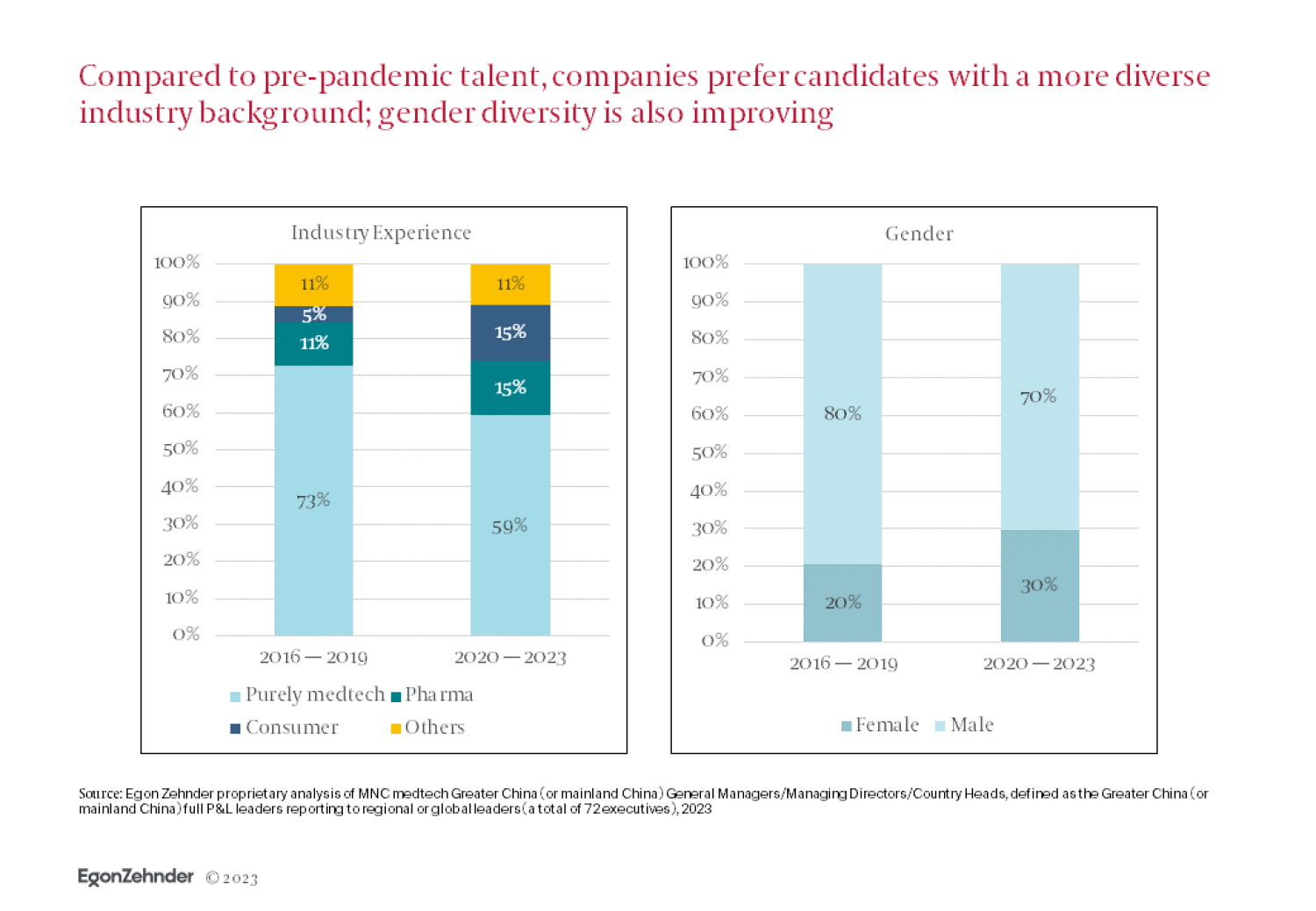

In response to this challenge, we observe newfound openness to diverse talent among China’s medtech companies. Prior to 2019, 73 percent of medtech GMs were recruited from within the industry. While companies still prefer candidates with a pure medtech background—as is the case for 59 percent of GMs—leadership profiles are diversifying so that 30 percent of leaders now bring expertise from the pharmaceutical and consumer industries, while 11 percent hail from other professional backgrounds. At the same time, there has been a 50 percent increase in women’s leadership in the medtech sector: women now hold 30 percent of GM positions, up from 20 percent in 2019.

Unlocking the leadership potential of established and emerging executives

Traditional commercial leaders, who have long steered China’s medtech companies with seasoned expertise, now find themselves facing a rapidly shifting marketplace. Concurrently, a new generation of leaders with less experience but a new set of insights is coming to the fore.

These leaders, both established and emerging, have exciting opportunities to shape the future of China’s medtech industry. All leaders bring their individual experiences and competencies to the table, as well as their own areas for growth. As companies navigate uncertainty and shape new strategies, they will do well to recognize the potential in their leaders and nurture their capabilities accordingly.

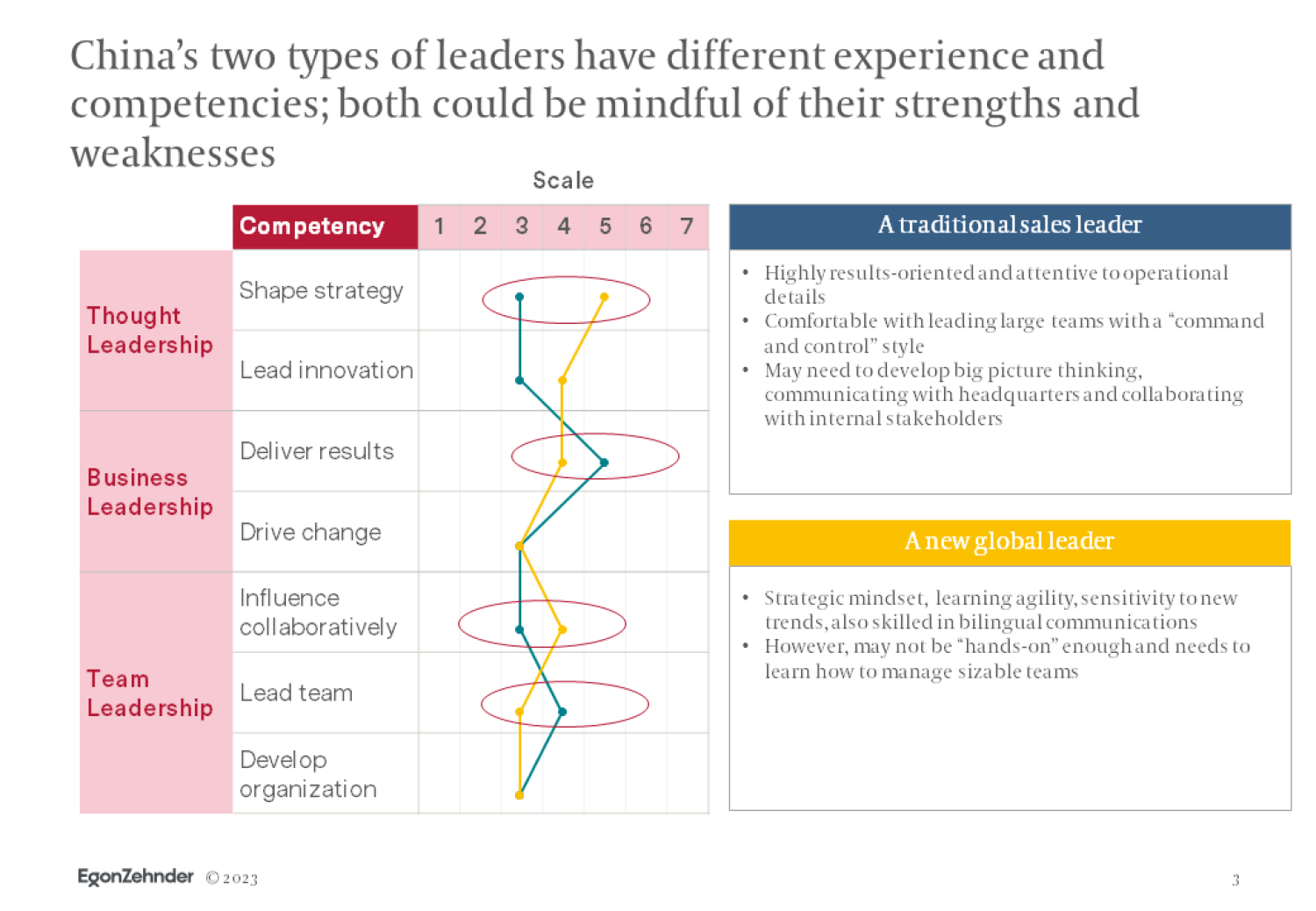

In our work with medtech companies, we observe two common leadership archetypes—each with its own set of strengths, challenges, and potential to be unlocked:

- Archetype 1: The traditional GM. These leaders often started out in frontline sales and climbed the ranks from there. They are typically highly results-oriented and attentive to operational details, with a top-down leadership style. However, they also often have a less global perspective and limited direct experience with the head office. Therefore, these more traditional-style GMs have opportunities to hone their potential with a focus on developing their big-picture thinking, strategy, and communication skills.

- Archetype 2: The new global leader. This archetype is a more diverse and younger candidate, educated overseas and with a background in management consulting. With experience in strategy and a history of collaborating with head office teams, these leaders often bring a strategic mindset, learning agility, an awareness of new trends, and bilingual proficiency. Nevertheless, their challenge may lie in operational acumen and managing larger teams. Here, the opportunity for growth revolves around bridging the operational gap and gaining practical experience in team leadership.

To build the leadership teams needed to succeed in a fast-changing environment, medtech companies can focus on three key actions:

- Commence succession planning as early as possible. Grooming a new senior leader, such as a CEO or general manager, takes time. Traditional CEO successions can take up to 18 months, and should not be rushed. Proactive succession planning can help anticipate future leadership needs. To understand these needs better, perform an inventory check of top candidates and future leaders to understand what hard and soft skills are needed.

- Focus on potential, not just experience. Remember that leaders are more than the sum of their experience. Past success is no guarantee of future performance. Whether recruiting internally or externally, companies can nurture leaders’ potential and provide the necessary support as they develop vision and strategic thinking to tackle new and complex challenges. Focus on their potential and offer appropriate, project-based exposure.

- Tailor guidance to leadership type. Companies can recognize the strengths and possible gaps inherent in both leadership archetypes—traditional and new global leaders —and support their development accordingly. For example, at Egon Zehnder we offer various programs to help high potential talent grow into future China GMs. For traditional leaders, a smaller project that requires global coordination and communication could be helpful for confidence building. Companies who recognize the capabilities of their employees will be able to coach them appropriately for the highest impact.

China’s medtech industry is undergoing a profound transition—and adaptive, innovative, and inclusive leadership is needed more than ever as companies navigate this evolving landscape. This is an opportunity to discover, cultivate, and empower leaders who can drive meaningful change and provide local solutions to local challenges.