The private capital sector has been experiencing unprecedented fund inflows and investment activity. Given our long-standing focus in this area, Egon Zehnder is uniquely equipped to address the growing talent-related demands. For decades, we often have been the partner most trusted by private capital firms looking to expand from their home base to new geographies — whether starting in Europe, the United States, Asia or elsewhere.

In recent years, we have seen increasing cases of foreign firms setting up shop in the United States, first-time shops hiring de novo teams, and existing firms raising new and bigger funds, deploying additional strategies (special situations, venture capital, growth equity infrastructure, and credit for instance). We have noted many limited partner organizations behaving more like general partners, developing their own investment capabilities. At the same time, the talent market has become more fluid than ever.

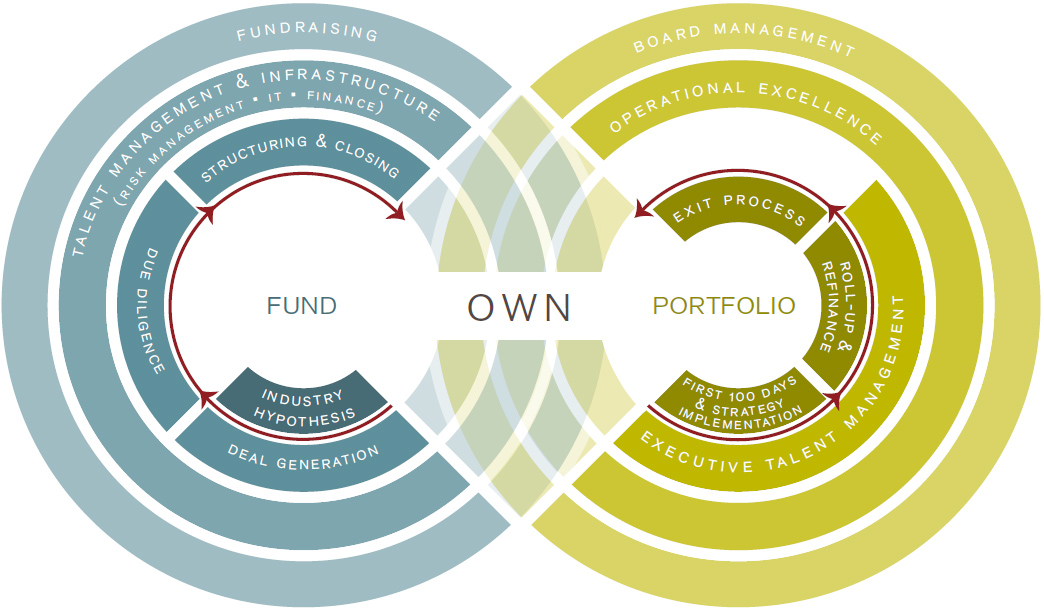

There are two distinct aspects to private capital talent sourcing. At the fund level, entities require top-caliber leaders across a full suite of roles: investment professionals, operating partners, senior advisers and functional leads such as human resources, investor relations, capital markets, CFOs, and COOs. At the portfolio level, C-suite and board positions across all industries are in high demand. For these highly regionalized businesses, we can draw upon our deep local and sector expertise across practices (Consumer, Health, Financial Services, Technology & Communications, Industrial, Services) — all aligned with their private capital counterparts.

These industry dynamics are aligned with Egon Zehnder’s One Firm model. Our geographic and sector breadth (including 70 offices across 36 countries) and deep expertise (our more than 600 consultants are hired almost entirely from industry, so we understand the prevailing issues) enable us to provide seamless services across countries. Although other consulting firms may also offer a single point of contact to support multi-region projects, at Egon Zehnder this structure is seamless and organic.

Despite significant financial incentives tying talent to existing shops, the rapid expansion of portfolios has fueled an enticing market for young top performers. This places the onus on private capital executive teams to manage their talent proactively and systematically, including shaping leadership successions, discovering leaders, developing leadership, advancing governance and unlocking transformation.

We welcome the opportunity to partner with you.