Take a stroll through any major German city, and chances are high you may stumble upon a familiar sight: torn up roads and newly dug holes making way for fiber optic cables. This messy chaos is common in urban areas across the continent, and, in many ways, symbolic of the evolution of the fiber market itself. As competitors scramble to claim their stake of a crowded market, some survive and thrive, while others fall out of the race altogether.

In Germany, this moment of truth has arrived. Signs indicate the fiber race may be entering a new phase of consolidation, and fiber companies are starting to ask whether they still have a right to play. Germany has around 250 players, ranging from heavyweight incumbents through to greenfield start-ups and small, local utility-backed city carriers, all jockeying for the “eternity returns” associated with this long-term infrastructure. Cable giant Liberty Global’s local fiber brand “HelloFiber” was the first high-profile casualty when it exited the market at the end of 2022, but it won’t be the last.

In fact, the frequency and volume of exits and mergers is likely to accelerate as the country ramps up its fiber rollout. As widely reported, Germany has been surprisingly slow to connect its citizens to fiber, but the German government has announced targets for full fiber coverage by 2030, and 50 percent by 2025. From a sluggish start, the country is now among the top three in Europe in terms of fiber deployment growth, behind France and the United Kingdom.

Both established telcos and greenfield players are “land grabbing” to get optic cables in the ground before their competitors do, and each group brings distinct strengths and weaknesses to the market. While established telcos have the scale, reputation, and financial heft to claim territory, they are often bogged down by legacy systems and technology and operational silos. Greenfield players can’t always match the money, experience, or existing customer base of incumbents, but can build new highperforming systems and technology platforms. Highly localized providers, meanwhile, have a strong regional or local authority presence but struggle to expand and develop the scale necessary for survival.

There is certainly space for all types of players in the German fiber market—but not enough space for everyone, as we are beginning to see. Different players are announcing fiber build-outs in the same regions, and all the rollout announcements made to date take the market beyond 100 percent coverage in 2030. This is unrealistic. Yes, there is still a lot of room for growth for those companies with robust strategies, but many companies are struggling to find the time and resources needed to develop a compelling proof of concept.

This period of consolidation makes for nervy times, and, as pressure builds on companies to deliver value and convince investors of their right to remain, now is the moment for market participants to step back and look at what is happening in Germany—and how this story has played out in other markets—and adapt their approach to ensure they remain in the race for the long haul.

The Nordic markets Denmark, Norway and Sweden, for example, have seen a continuous stream of consolidation, with local fiber companies adjusting their operating models and commercial strategies to accommodate local market developments over time. German fiber companies now need to navigate the uncertainty that comes with a period of consolidation, while also addressing the peculiarities of the German market: bureaucracy, regulatory burdens, high per-home connection costs, overbuild challenges, and decreasing customer willingness to pay more for coverage and speed due to inflationary pressures on real incomes.

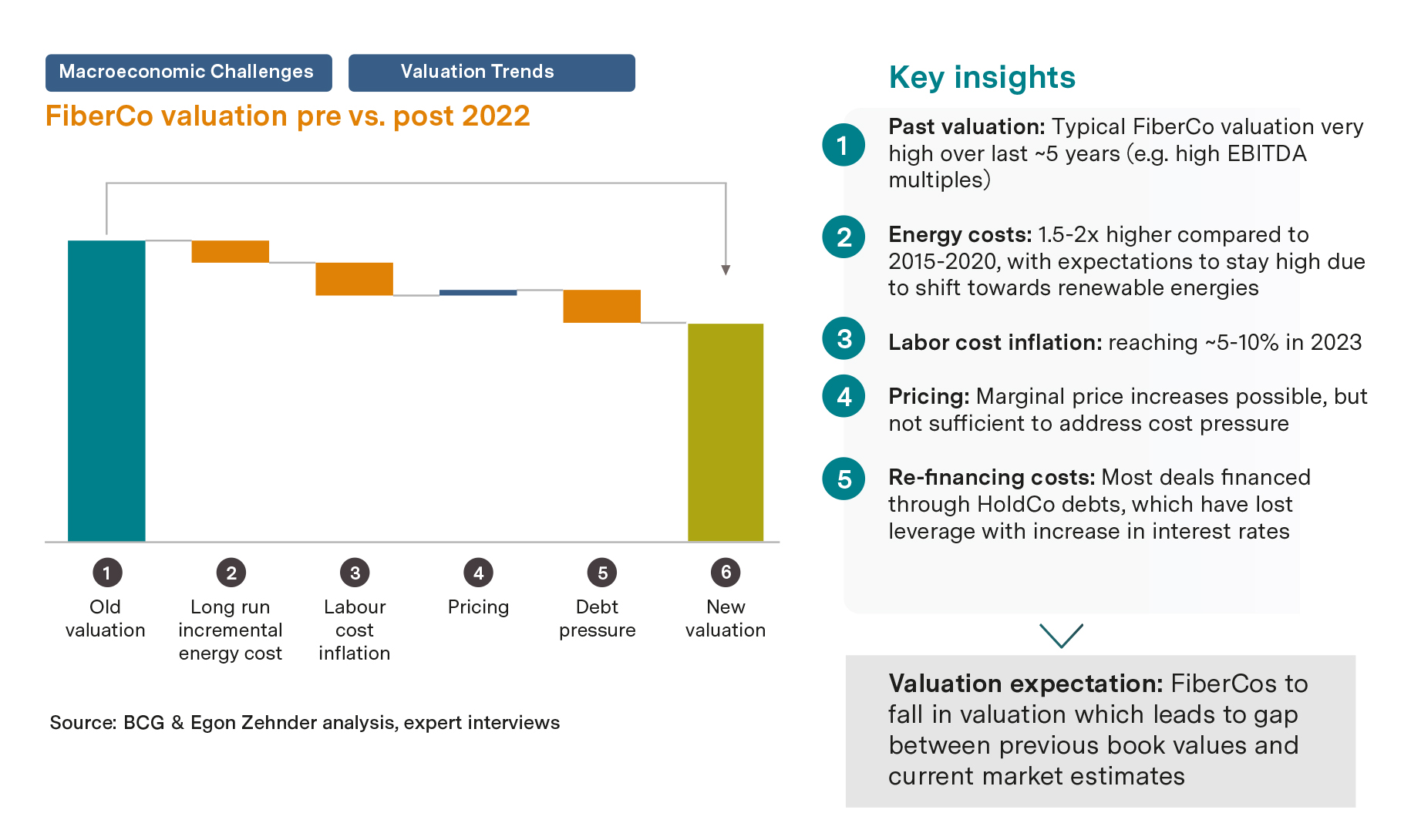

Figure 1: Fiber company valuations have declined due to macroeconomic pressures.

Vicious or virtuous circle: Navigating the three phases of the fiber race

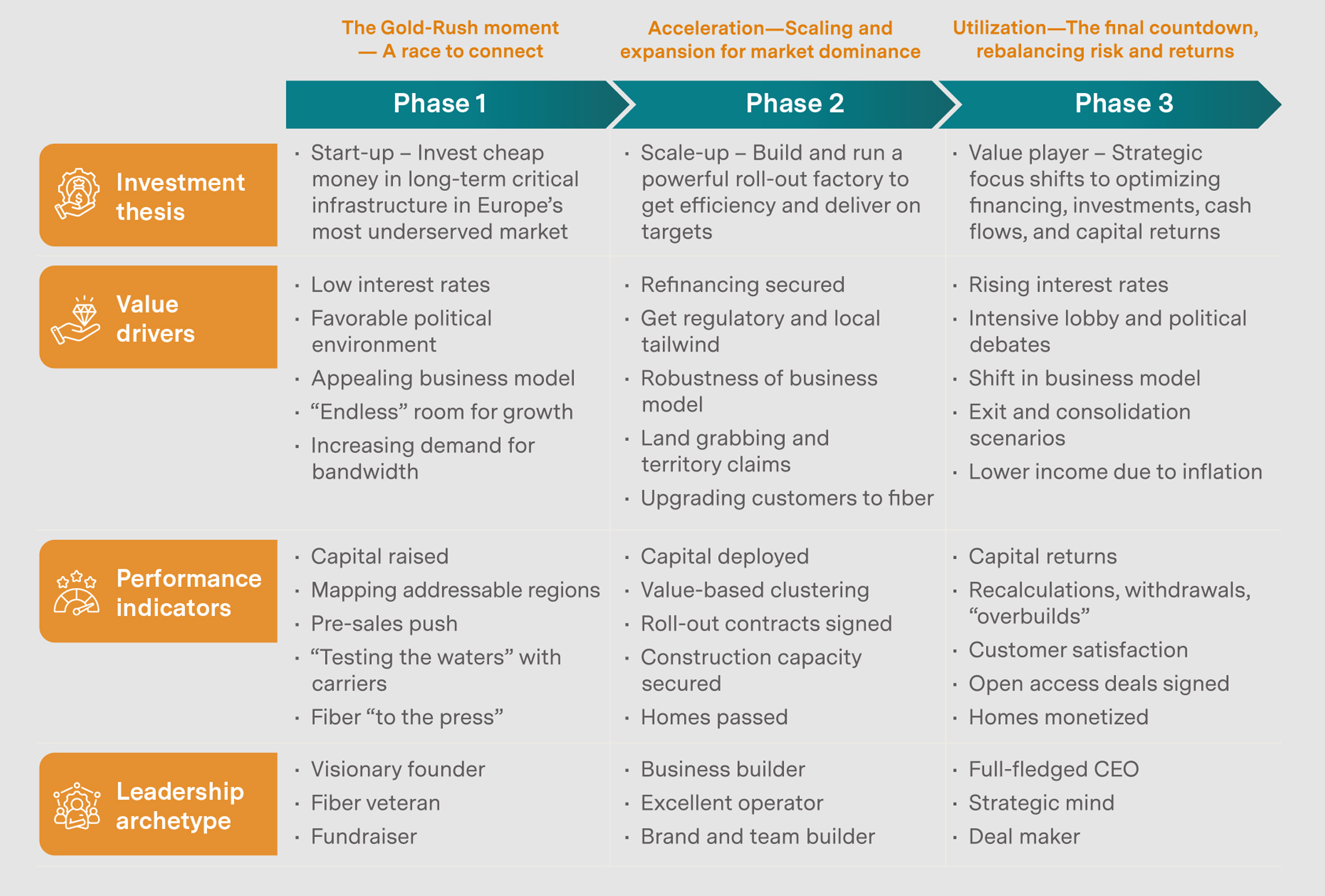

As pressure mounts on Germany’s fiber companies to gain customers and prove their investment credentials, leaders of these businesses need to lift their gaze beyond day-today firefighting to see where they fit within the broader fiber market. They can do so by understanding the three distinct phases of the fiber race, and the leadership capabilities and organizational strengths needed to succeed in each phase (Figure 2).

In phase one—the gold-rush moment—companies hurried to enter the market, raise capital, build leadership teams, and boldly announce rollout targets without evidence for actual delivery (“fiber to the press”). At this stage, the most pioneering, visionary companies and leaders with strong fundraising capabilities attracted the greatest investments and announced the most aggressive targets. With cheap capital flooding an underserved market, investment reached a fever pitch, and performance was measured not in terms of capital deployed, or even capital returns, but by capital raised.

This was followed by a second phase of acceleration, where companies had to set their strategies in motion, scale, and deploy the capital raised in phase one. With leadership teams in place, fiber rollouts began, and companies started racking up their count of “homes passed” (though not necessarily connected). From a business point of view, the focus turned to how to operationalize the strategy, industrialize the rollout process, and build a viable business to deliver on the targets announced in phase one. Leaders had to pivot from being visionary founders to operationally excellent business builders.

In phase three, the pressure has started to build as investors look for capital returns through homes connected and actual customers on the books. This is the final countdown, where companies need to rebalance risk and return, and the strategic focus has shifted to optimizing investments and cash flow. Those businesses without much to show from earlier phases are being exposed and failing to secure the additional financing needed to scale. This has not been helped by a range of macroeconomic pressures, including higher interest rates, reducing the valuations of fiber companies since the start of 2023 (Figure 1).

Figure 2: Fiber companies are on a three-phase journey, with signs pointing to a period of market consolidation.

Source: BCG & Egon Zehnder analysis, expert interviews

Germany is now in phase three, where companies need to achieve scale, generate cash flows, and secure capital returns to remain viable. The recipe for success will be very different to the recipes that worked in earlier phases—from the type of leadership required to the drivers of value and key performance indicators.

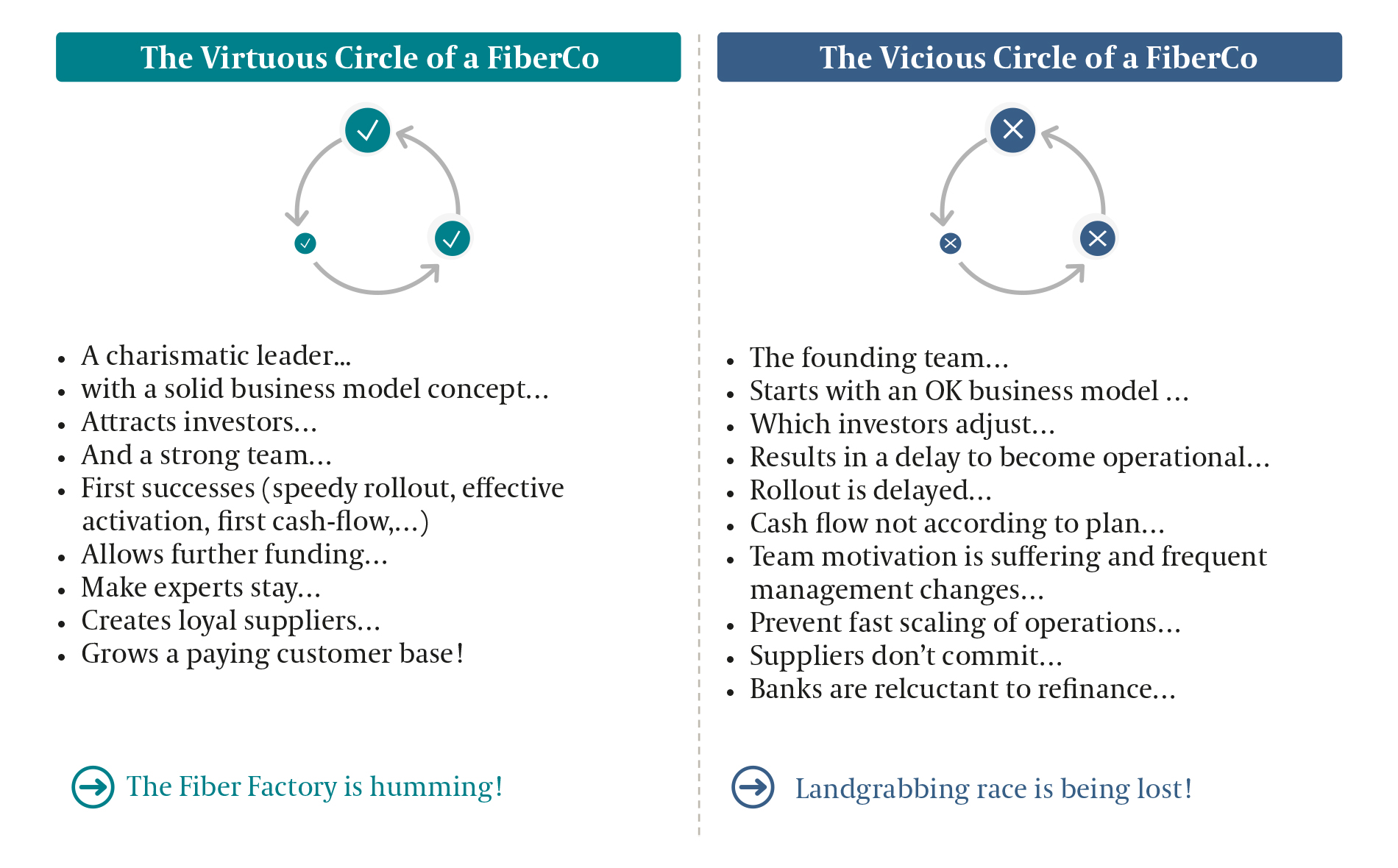

Those companies that build the right leadership team, attract, develop and retain talent, and continuously improve operational performance can enter a virtuous circle and prosper (Figure 3). But those that fail to build the right operational and leadership capabilities—and who did not do enough land grabbing in earlier phases—could enter a vicious circle of decline, where they struggle to attract and retain the right talent and grow a paying customer base, and, ultimately, lose investor confidence.

Figure 3: Leaders need to act decisively at the first signs of vicious decline.

Source: BCG & Egon Zehnder analysis, expert interviews

This cycle of decline can happen at lightning-quick speed. Delays to fiber rollout and land grabbing can be devastating to any business case, exposing strategic and operational weaknesses, and making it almost impossible to secure funding and supplier commitments. Leaders who recognize these signs of decline in their business need to act quickly and decisively to claw their way out of the vicious cycle.

Make or break: Leadership as the deciding success factor

If the name of the game is now about scaling and securing returns, fiber companies need to ask whether they have the right strategy to grow into viable, sustainable, “grown-up” businesses. And, if so, do they have the operational excellence needed to deliver fantastic service and a delightful customer experience?

In this highly competitive environment, the right kind of leadership may be the makeor-break factor in determining which businesses enter a virtuous cycle, and which spiral into a vicious cycle of decline. And here’s the dilemma: executives need the skills and capabilities of great scale-up leaders, without creating the typical corporate structure. In other words, they need to build high-performing teams that can deliver the strategy, while retaining the nimble, dynamic features of a start-up that can adapt to evolving threats and opportunities.

The most successful leaders may be those who can identify, evaluate, pick, and execute the best strategic options. They need to be alive to M&A opportunities and initiate smart partnerships with suppliers. They may need to marshal IT and cultural integrations, and strike value-creating deals to please shareholders. None of this is easy.

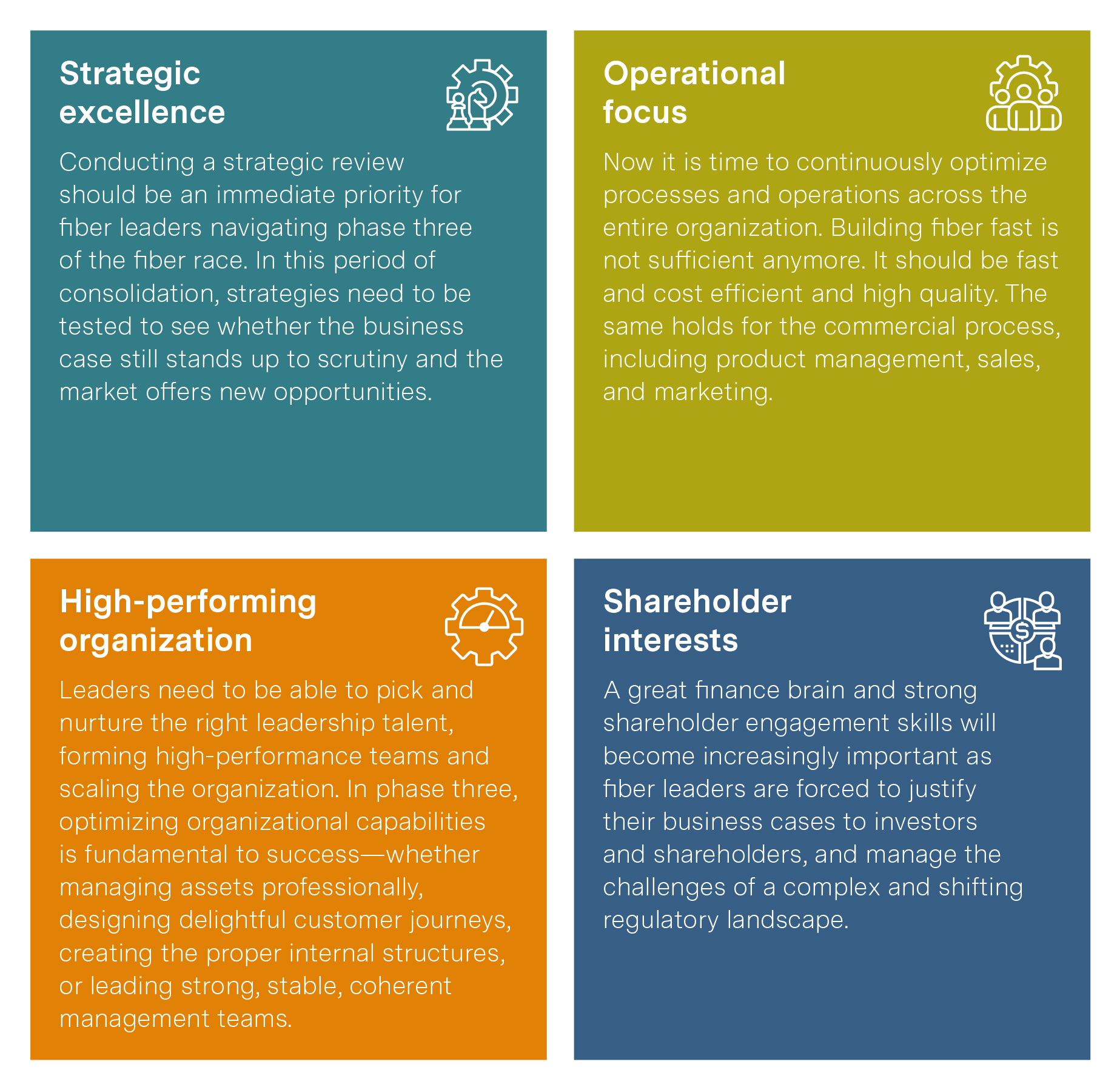

In this context, leaders need four distinct management priorities: strategic excellence, strict focus on operational delivery, the ability to build a high-performing organization, and prudent management of shareholder interests.

And all of this must be done in a dynamic environment where investors, customers, competitors, and operational context can move on quicker than companies can keep up—or even realize the need to adapt.

The German fiber market is still very attractive and the case for investment is still strong. However, it’s time to take stock, analyze, and adapt strategies, and assess whether management teams are up to the task ahead, or stuck in the gold-rush logic of phase one. If honest appraisals suggest there is no longer a viable business case to answer, a merger or market exit may be the inevitable conclusion. (And if this is the case, it may be better to do it sooner than later).

While this phase of consolidation may spell the end of some fiber businesses, it will also mean opportunity for others. Assets will be up for grabs for those companies that can move quickly and decisively to merge with or take over competitors that offer complementary strengths, whether it be a winning technology platform, large customer base, or foothold into a new region.

Wherever leaders are, they will need to brace themselves. This is a fast-paced environment, where the change cycle can happen in a year or less. The CEOs who win may be the ones who take stock and ask these strategic questions most frequently. Those who don’t may find themselves unable to dig themselves out of a hole.