As contract development and manufacturing organizations (CDMOs) in the biopharma space have boomed and broadened their capabilities in recent years, they have entered a more complex era that presents a host of new challenges. One of the most constraining challenges starts at the top: CDMOs, now a formidable player in the development and manufacturing ecosystem, need comparably capable and forward-thinking leadership talent to drive this next chapter of growth.

This was not always the case. Before the influx of mergers and acquisitions and private equity investment sweeping across the industry segment, CDMOs grew up with largely “home grown” talent. These executives successfully led businesses that operated primarily as support functions to the higher-value, more profitable segments of the biopharma value chain.

The landscape is evolving rapidly.

Now CDMOs face a transformed landscape. The biopharma industry is increasingly looking to them as integral partners to pipeline and commercial success. For example, clients are choosing to outsource more development and manufacturing jobs rather than expand in-house capabilities. They are engaging in more risk-sharing agreements to manage project outcomes. Meanwhile, the CDMOs are becoming increasingly competitive and broadening their own capabilities. For instance, Thermo Fisher Scientific recently announced the acquisition of the CDMO Brammer Bio for $1.7 billion to gain access to its gene therapy development and manufacturing assets. Catalent also just acquired Paragon Bioservices for $1.2 billion, adding expertise in viral vector development and manufacturing to Catalent’s end-to-end biologics portfolio of services.

The winning CDMOs are choosing a different path forward.

As CDMO customers have become increasingly demanding – expecting a true partnership across technical, management and commercial disciplines – the existing talent bench may not be prepared to lead and succeed in this new, more complex environment. Until recently, talent development and CEO-succession planning were not pressing priorities within CDMOs. This has led to a talent shortage in this booming space, and will curtail growth and drag on the high expectations of the CDMO if not properly addressed.

Some are reconfiguring their teams to prepare for the next chapter. But many in the industry have yet to transform. To address this growing leadership void, CDMOs need to take three critical steps:

1. Update leadership expectations.

When building the right leadership team, CDMOs need to assess and recruit on new terms, focusing on what is important for a successful leader and letting go of previous expectations to “know the space.” While technical experience is valuable, talent research shows that the best leaders can move up the learning curve quickly. Instead, it’s essential to focus on the leadership competencies that matter:

-

Velocity – can the leader operate nimbly, with a sense of urgency? Can the individual make decisions from limited information? Can he or she make mistakes and correct quickly? Operate in a more agile environment?

-

Customer intimacy – does the leader seek to deeply understand customer needs and deliver in a holistic way beyond just commercial terms? Can the individual step into the customer’s shoes and understand his/her pain points to serve effectively?

-

General Management mindset – does the individual understand the customer’s and his/her own business model and the drivers of each line in the Profit & Loss (P&L)?

-

Capability builder – is this leader an attractor for other strong talent? Does he or she build and nurture their teams to get the best from them? Does he or she build capabilities both within their own teams, but also more broadly for the organization?

2. Assess future potential.

At Egon Zehnder, we encourage companies to take a holistic view of leadership potential. Our Potential Model gives companies a framework on which to evaluate candidates by considering their traits and future potential, rather than just their resumes.

The Egon Zehnder Potential Model looks at four traits. They are:

-

Curiosity – is the individual driven to proactivity seek understanding and new learning? Can he or she learn through feedback?

-

Insight – does the individual processes information from many sources and use it to shape insights that make sense of ambiguity and break the status quo?

-

Engagement – can this individual engage the hearts and minds of others to deliver shared objectives and mutual benefits? Does he or she gain energy from authentically connecting with others and understanding them on a deep level?

-

Determination – is this individual able to enjoy a challenge but not let strength of purpose descend into stubbornness? Will he or she take on risks with ingenuity and tenacity, but can stay nimble and change direction when needed?

3. Tell the story of the new CDMO leadership opportunity.

To get the right talent, CDMOs need to sell their story. Many candidates still have the misperception of the past, assuming the more challenging and prestigious positions reside in the BioPharma firms. The truth is that CDMOs now offer wide opportunities to develop leadership skills while delivering significant impact. What CDMOs can offer the aspiring leader:

-

Be a “CEO” – the chance to be a General Manager (GM) provides the experience and rigor of managing your own business. Many of the CDMOs operate as discrete businesses, giving their leaders true end-to-end GM opportunities, from managing teams and a P&L to building long-term customer relationships.>

-

Entrepreneurialism and Autonomy – more creativity and independence are often possible in this space versus larger BioPharma companies.

-

Innovation – we hear from candidates who have grown up in BioPharma, “But I want to be close to the innovation.” At a CDMO, leaders are exposed to innovation at scale, and get to take broad portfolios from pilot through lifecycle.

-

Growth – while many BioPharma companies have consolidated, CDMOs continue to grow.1 Pfizer, Bayer, and Teva all trimmed their workforces in the past 18 months; meanwhile, leading CDMOs like Lonza and Catalent continue to expand their operations and headcounts.2

-

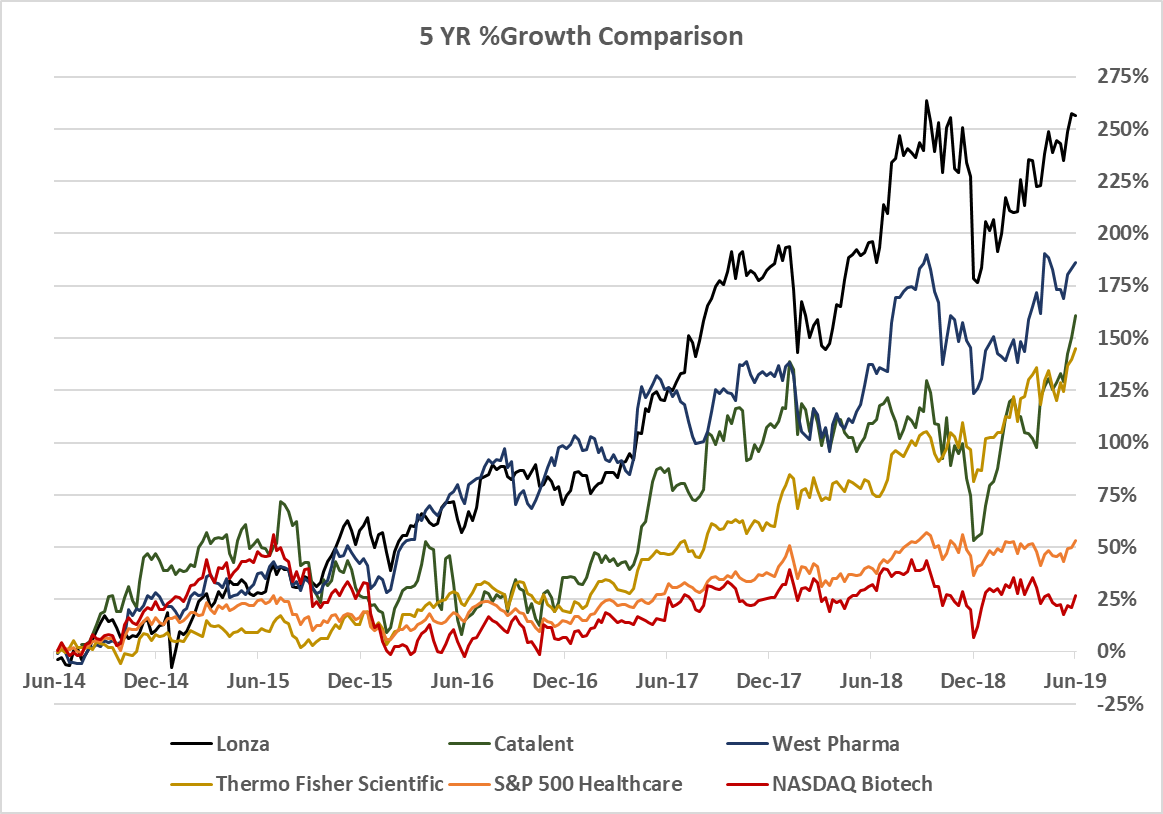

Wealth Creation – with the high-level private equity and strategic investments in the space, the potential for financial gain can be very lucrative upon a transaction. Within the public markets, the top CDMOs are significantly outperforming the broader health and biotech sectors (see chart). Stock appreciation at these large CDMOs is out-pacing the broader Health and Biotech sector by 3-4x in the 1-year and 5-year timeframes. The average appreciation in these three CDMOs was 201% from June 2014* to June 2019, compared to 53% in the S&P 500 Health Care index, and 27% in the NASDAQ Biotech Index. In the past year, the CDMOs appreciated 22%, compared to 9% and -4%, respectively. (Source: Bloomberg)

Select CDMO performance vs. S&P Healthcare and NASDAQ Biotech

The leader’s call to action.

Today’s best-performing organizations understand the balance of specialization and scale, and they are willing to let the experts do what they do best. This has fueled the growth and investment in CDMOs, and the trend will only continue. But to take advantage of the opportunity, CDMOs must be willing to step up and embrace the leadership challenge. Those that succeed in the new era will be the companies willing to find the right talent to lead the way.

Sources

1. https://www.biopharmadive.com/news/where-are-pharmas-biggest-layoffs-happening/547465/

Topics Related to this Article

This article originally appeared in Contract Pharma. You can view the original article here.