Sustainability and disruptive technologies are increasingly dominating the corporate agenda today. These change agents bring a clear and present challenge to businesses and boards in Singapore and globally with the need to evolve rapidly or risk losing out in this complex landscape.

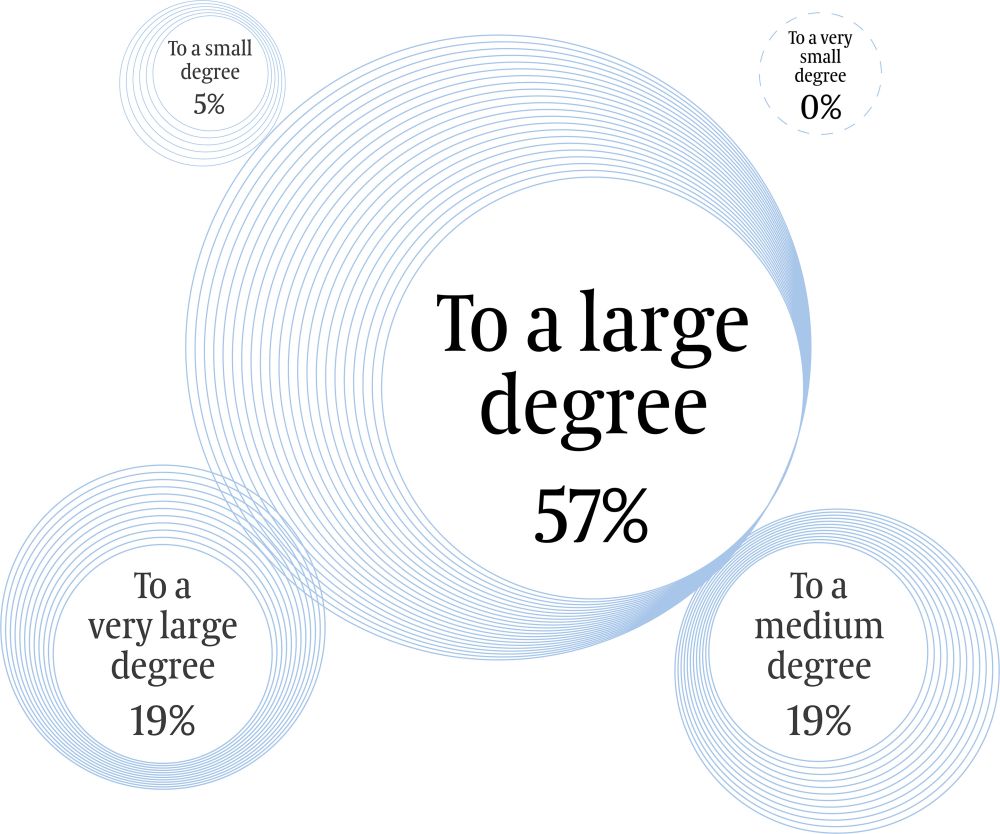

Findings from the Egon Zehnder 2024 Global CEO Survey, The CEO Response, show that 95 per cent of over 470 CEOs anticipate unprecedented changes will make significant and systemic shifts in the coming decade.

An overwhelming majority of CEOs expect “groundbreaking systemic changes” in the next decade.

Leaders are re-examining their roles and areas where they can have an impact. Some 80 per cent of CEOs acknowledge an expanded role beyond leading their companies by collaborating with governments and other stakeholders to shape new societal realities.

These findings reveal not only the magnitude of the changes ahead for CEOs but also highlight the critical role that boards must play in guiding CEOs and their organisations through this landscape. Boards are no longer just responsible for governance and compliance – they must now act as strategic leaders, the moral compass to steer organisations through complex and evolving risks.

Interestingly, climate change emerged as the top concern for CEOs in the Asia Pacific, while populism and nationalism topped the list for CEOs based in Europe and North America. Additionally, the regulation of new technologies like artificial intelligence (AI) and the natural and humanitarian crises caused by climate change were identified as the two biggest opportunities for CEOs to build common ground between businesses, governments and other stakeholders.

In Singapore, the stakes are even higher. Starting FY 2025, the Singapore Exchange Regulation (SGX RegCo) requires all listed companies to disclose Scope 1 and Scope 2 greenhouse gas emissions, aligning with the International Sustainability Standards Board (ISSB) and Task Force on Climate-related Financial Disclosures (TCFD) standards.

Are today’s boards future-ready?

Since SGX’s phased approach began in FY 2022, boards have had time to move beyond compliance and embed environmental, social and governance (ESG) principles into the strategic fabric of their organisations. But these requirements prompt a broader question: Are today’s boards prepared to lead through a future defined by sustainability challenges and technological disruption?

For many, the answer is no.

Many boards are not fully prepared for these demands as outdated structures and mindsets make it challenging for directors to prioritise emerging areas like technology, disruption and ESG alongside the CEO. The question is no longer whether boards must adapt but how swiftly they can evolve to meet tomorrow’s challenges.

As boards make the transition from compliance to strategy-driven change, three key challenges stand in the way:

-

Board culture impedes change

Expectations placed on boards are shifting – boards are now required to serve as a strategic force, helping companies navigate complex and unprecedented challenges. However, for many boards, this shift remains aspirational rather than operational. Traditional governance structures often do not incentivise directors to proactively drive change, leading some board members to refrain from “rocking the boat” and raising sensitive issues unless encouraged explicitly by the chair. As a result, a culture of avoiding challenging discussions can develop, stalling progress on critical issues.

-

Lack of expertise and preparedness in complex risk areas

Despite regulatory demands – such as the SGX’s requirements for greenhouse gas emissions disclosures – many boards lack the expertise to effectively address these evolving challenges. Egon Zehnder’s global Board Stewardship for a Resilient Business (2024), conducted in partnership with Nasdaq and Climate Governance Initiative, found that only one in four of directors feel confident in their knowledge and ability to meaningfully engage on sustainability risks and opportunities.

This knowledge gap is further reflected in outdated board performance metrics. The Forward Looking Board: Insights from Board Members (Egon Zehnder, 2024), found that 68 per cent of CEOs say that the metrics their boards use to steer decisions have remained consistent over the past three years. In ranking six key metrics, ESG metrics came in last, behind financial metrics, growth, talent management, innovation, and health and safety.

-

The CEO-board relationship gap

A critical lever for future-readiness and effective governance is a strong, collaborative relationship between the board and CEO. Every board member has a part to play in building a relationship with the CEO while maintaining a balance of independence to preserve good governance.

Boards need to up their game and understand what it takes to lead in complexity. In the 2024 Global CEO study, CEOs ranked their best resource for discussing and making sense of navigating challenges to be leadership teams first (35 per cent) and other CEOs second (28 per cent), while the independent board of directors ranked third at 17 per cent, and their chairs came in at 13 per cent.

In some sectors, such as banking, boards may be overly involved in operational decisions, which limits their capacity to provide strategic oversight. Conversely, many board members lack the close relationships with CEOs and executive teams to drive meaningful change.

The Future-Ready Board

Four critical trends can help transform boards into proactive, strategic partners to CEOs.

1. The moral compass of the organisation

Historically, boards prioritised profit maximisation, with a limited focus on social responsibility. Milton Friedman’s view that a business’s only social responsibility is to increase profits prevailed for decades. However, boards are increasingly expected to act as moral compasses, balancing financial performance with societal impact.

The rise of stakeholder capitalism has shifted expectations. Boards are now judged not only on profits but on their environmental and societal impact. As Warren Buffet’s “newspaper test” suggests, boards should consider how decisions would be perceived if reported publicly and read by the board’s family, friends and neighbours.

Boards are being called to hold the higher bar on conduct or it will be hoisted on them. For example, Australia’s Royal Commission into Misconduct in Banking holds boards and CEOs accountable for financial misconduct, such as one case of charging premiums to thousands of deceased clients for financial advice.

An Australian financial institution had to undergo significant change in strategy, personnel, and thus culture on the board as it went through a forced and embarrassing transition towards having a clearer compass on its civic and social responsibilities as an institution.

Moves with foresight are already taking place. One example is Temasek’s commitment to sustainability in the Temasek Charter through its T2030 strategy, Every Generation Prospers. The charter supports the development of its T2030 strategy to build a resilient and forward-looking portfolio, with sustainability at its core, and applying an internal carbon price to raise the bar on assessing long-term climate resiliency and returns expectations for investments.

Clear positions such as these by the board will enable the company to uphold its stated commitment to carbon neutrality in its operations and demonstrate commitment to its net zero, nature-positive and inclusive growth strategy.

2. The accelerator of change

To stay competitive, boards and their members must now adapt at a much faster pace than ever. In the past, boards were often composed of long-serving executives from the same industry, valuing stability over rapid evolution. However, as industry boundaries blur and technology disrupts, boards must diversify their expertise to stay competitive.

More than ever, boards urgently need diverse perspectives and expertise to accelerate business transformation. This shift will also lead to more balanced, inclusive board composition and shorter tenure, allowing boards to remain agile and capable of guiding organisations through fast-paced changes.

The only effective way forward is cohesive teamwork to navigate change. In the over 700 board assignments conducted by Egon Zehnder annually, we support boards in developing the right skills matrix and diverse composition to effectively leverage AI, digital transformation and sustainability as tools for value creation, not just risks to be managed. Critically, the solutions lie in having the right leadership on the executive team and, at times, the board to guide the organisation toward future-proofing strategies.

The essence of leadership versus management is to lift up, inspire and be future-focused. Boards should not micromanage nor be neutral, neither should they maintain a risk-averse, apparently “safe” flight path. Leadership is to energise. Consider: what are the prevailing emotions and energy levels when CEOs see a board meeting in the diary? Or when the CEO and Exco members leave a board meeting? How can the board elevate and, from the right altitude, sense future possibilities?

3. The learning and development machine

Traditionally, board development and learning were seen as non-issues. With business strategies perceived as relatively stable, there seemed to be little need for continuous learning at the board level. However, as business challenges grow increasingly complex, this paradigm is shifting.

Future-ready boards recognise that constant learning and development are essential for all members. This shift involves conducting comprehensive board effectiveness reviews and adopting new techniques for decision-making in diverse and evolving environments.

However, the responsibility of emerging areas should not rest on the shoulders of a single board member. Creating a critical mass of board members with a collective understanding of digital transformation and technology is far more effective than relegating this crucial mission of transformation to “the” technology-proficient person. Boards benefit when multiple directors are equipped to ask the right questions, fostering clarity on how their companies can leverage technology to drive sustainable growth.

Many chairs are also continuously upgrading their abilities to bring the best out of board members. In customised development programmes for board chairs globally, they seek to be masters of complexity and “meaning makers” skilled in advocating and balancing the needs of diverse stakeholders.

Does the board have the capacity to consider all its sensory capacities? To what degree will they help expand the conscious awareness of the board on the relational or societal dimensions? Is the energy of conversations rooted in fear and risk, or does the leadership repertoire of board members include stretching to possibilities and reimagining the future?

4. The culture shaper

Corporate culture has long been considered peripheral to board discussions, but this is rapidly changing. Today, the link between corporate culture and performance is widely recognised, and boards are taking a more active role in shaping and monitoring culture within their organisations.

A dual-listed board in China exemplifies this shift. The board, diverse in composition, played an active role in modelling behaviour and influencing the organisation’s culture. Aspiring to be world-class, they embraced open feedback on their performance individually and collectively. They take pride in being proactive, responsive, and forward-looking – qualities that have fostered a culture committed to continuous improvement.

Over time, this approach has led to more streamed communications, enhanced performance standards, and strengthened alignment between the board and the CEO, with raised expectations on both sides. In this case, role modelling behavioural change at the top catalysed broader cultural and performance improvements across the organisation.

Leading the change

In an era of seismic shifts, from climate to technological upheavals, boards must do more than keep pace – they must lead the charge. However, future readiness doesn’t come from compliance or ticking boxes; it requires boards to step back regularly, scrutinise their decisions, and question how they arrived at them.

Board effectiveness reviews are essential for this kind of introspection. By incorporating these reviews into their routine, boards can expose blind spots, strengthen alignment, and ensure their processes are as adaptive as their challenges. This regular “holding up the mirror” pushes boards beyond comfort zones, making them more accountable, agile and impactful.

In short, boards that commit to continuous self-examination won’t just react to the future – they will shape it. The question isn’t just whether today’s boards are ready for tomorrow but whether they’re prepared to redefine the future of governance itself.

This article was first published in the Q1 2025 issue of the Singapore Institute of Directors.